Form Lg-1 - Vermont Land Gains Withholding Tax Return

ADVERTISEMENT

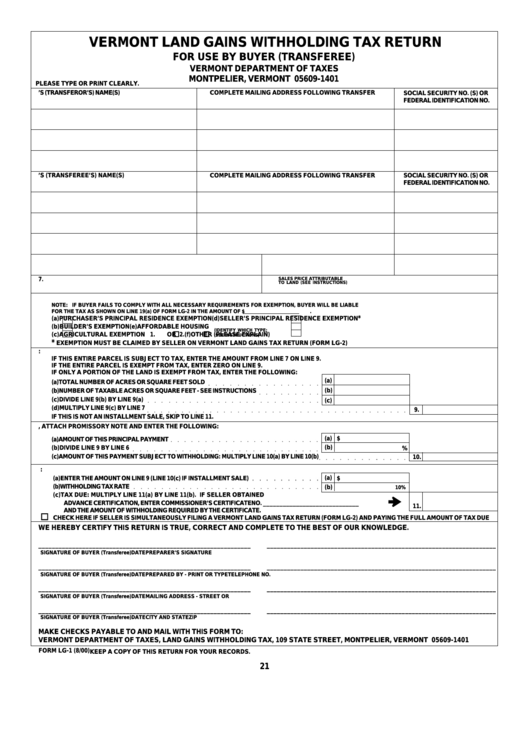

VERMONT LAND GAINS WITHHOLDING TAX RETURN

FOR USE BY BUYER (TRANSFEREE)

VERMONT DEPARTMENT OF TAXES

MONTPELIER, VERMONT 05609-1401

PLEASE TYPE OR PRINT CLEARLY.

1.

SELLER’S (TRANSFEROR’S) NAME(S)

COMPLETE MAILING ADDRESS FOLLOWING TRANSFER

SOCIAL SECURITY NO. (S) OR

FEDERAL IDENTIFICATION NO.

2.

BUYER’S (TRANSFEREE’S) NAME(S)

COMPLETE MAILING ADDRESS FOLLOWING TRANSFER

SOCIAL SECURITY NO. (S) OR

FEDERAL IDENTIFICATION NO.

3.

PROPERTY LOCATION

4.

DATE ACQUIRED BY SELLER

5.

DATE OF CLOSING

6.

TOTAL SALES PRICE

SALES PRICE ATTRIBUTABLE

7.

TO LAND (SEE INSTRUCTIONS)

8.

EXEMPTIONS CLAIMED BY BUYER - CHECK BOX IF APPLICABLE.

NOTE: IF BUYER FAILS TO COMPLY WITH ALL NECESSARY REQUIREMENTS FOR EXEMPTION, BUYER WILL BE LIABLE

FOR THE TAX AS SHOWN ON LINE 19(a) OF FORM LG-2 IN THE AMOUNT OF $

.

*

(a)

PURCHASER’S PRINCIPAL RESIDENCE EXEMPTION

(d)

SELLER’S PRINCIPAL RESIDENCE EXEMPTION

(b)

BUILDER’S EXEMPTION

(e)

AFFORDABLE HOUSING

(IDENTIFY WHICH TYPE;

o

o

(c)

AGRICULTURAL EXEMPTION 1.

OR 2.

(f)

OTHER (PLEASE EXPLAIN)

SEE INSTRUCTIONS)

*

EXEMPTION MUST BE CLAIMED BY SELLER ON VERMONT LAND GAINS TAX RETURN (FORM LG-2)

9.

SALES PRICE ATTRIBUTABLE TO TAXABLE LAND:

IF THIS ENTIRE PARCEL IS SUBJECT TO TAX, ENTER THE AMOUNT FROM LINE 7 ON LINE 9.

IF THE ENTIRE PARCEL IS EXEMPT FROM TAX, ENTER ZERO ON LINE 9.

IF ONLY A PORTION OF THE LAND IS EXEMPT FROM TAX, ENTER THE FOLLOWING:

(a)

(a) TOTAL NUMBER OF ACRES OR SQUARE FEET SOLD

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

(b)

(b) NUMBER OF TAXABLE ACRES OR SQUARE FEET - SEE INSTRUCTIONS

○

○

○

○

○

○

○

○

○

(c) DIVIDE LINE 9(b) BY LINE 9(a)

(c)

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

(d) MULTIPLY LINE 9(c) BY LINE 7

9.

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

IF THIS IS NOT AN INSTALLMENT SALE, SKIP TO LINE 11.

10. IF THIS IS AN INSTALLMENT SALE, ATTACH PROMISSORY NOTE AND ENTER THE FOLLOWING:

(a)

$

(a) AMOUNT OF THIS PRINCIPAL PAYMENT

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

(b)

(b) DIVIDE LINE 9 BY LINE 6

%

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

(c) AMOUNT OF THIS PAYMENT SUBJECT TO WITHHOLDING: MULTIPLY LINE 10(a) BY LINE 10(b)

10.

○

○

○

○

○

○

○

○

○

○

○

○

○

11. TAX DUE:

(a)

(a) ENTER THE AMOUNT ON LINE 9 (LINE 10(c) IF INSTALLMENT SALE)

$

○

○

○

○

○

○

○

○

○

○

(b) WITHHOLDING TAX RATE

(b)

10%

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

○

(c) TAX DUE: MULTIPLY LINE 11(a) BY LINE 11(b). IF SELLER OBTAINED

ADVANCE CERTIFICATION, ENTER COMMISSIONER’S CERTIFICATE NO. _____________________________

11.

AND THE AMOUNT OF WITHHOLDING REQUIRED BY THE CERTIFICATE.

o

CHECK HERE IF SELLER IS SIMULTANEOUSLY FILING A VERMONT LAND GAINS TAX RETURN (FORM LG-2) AND PAYING THE FULL AMOUNT OF TAX DUE

WE HEREBY CERTIFY THIS RETURN IS TRUE, CORRECT AND COMPLETE TO THE BEST OF OUR KNOWLEDGE.

_______________________________________________________________

____________________________________________________________________

SIGNATURE OF BUYER (Transferee)

DATE

PREPARER’S SIGNATURE

_______________________________________________________________

____________________________________________________________________

SIGNATURE OF BUYER (Transferee)

DATE

PREPARED BY - PRINT OR TYPE

TELEPHONE NO.

_______________________________________________________________

____________________________________________________________________

SIGNATURE OF BUYER (Transferee)

DATE

MAILING ADDRESS - STREET OR P.O. BOX

_______________________________________________________________

____________________________________________________________________

SIGNATURE OF BUYER (Transferee)

DATE

CITY AND STATE

ZIP

MAKE CHECKS PAYABLE TO AND MAIL WITH THIS FORM TO:

VERMONT DEPARTMENT OF TAXES, LAND GAINS WITHHOLDING TAX, 109 STATE STREET, MONTPELIER, VERMONT 05609-1401

FORM LG-1 (8/00)

KEEP A COPY OF THIS RETURN FOR YOUR RECORDS.

21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1