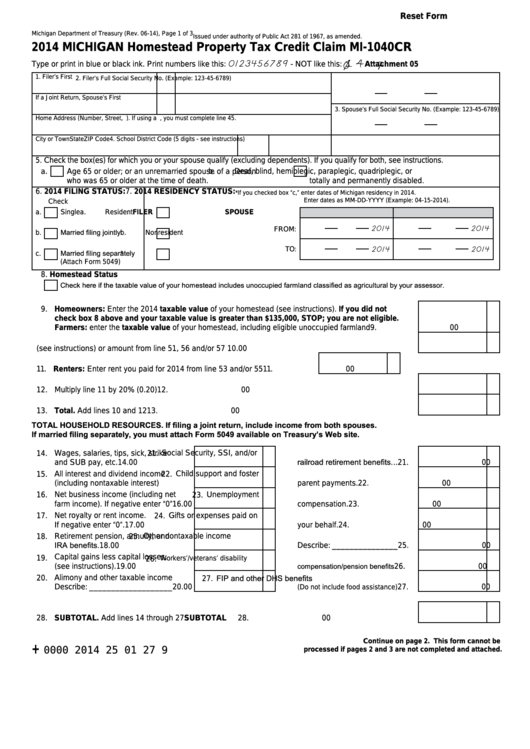

Reset Form

Michigan Department of Treasury (Rev. 06-14), Page 1 of 3

Issued under authority of Public Act 281 of 1967, as amended.

2014 MICHIGAN Homestead Property Tax Credit Claim MI-1040CR

1 4

0123456789

Type or print in blue or black ink. Print numbers like this:

- NOT like this:

Attachment 05

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Full Social Security No. (Example: 123-45-6789)

Home Address (Number, Street, P.O. Box). If using a P.O. Box, you must complete line 45.

City or Town

State

ZIP Code

4. School District Code (5 digits - see instructions)

5. Check the box(es) for which you or your spouse qualify (excluding dependents). If you qualify for both, see instructions.

a.

Age 65 or older; or an unremarried spouse of a person

b.

Deaf, blind, hemiplegic, paraplegic, quadriplegic, or

who was 65 or older at the time of death.

totally and permanently disabled.

6. 2014 FILING STATUS:

7. 2014 RESIDENCY STATUS:

*If you checked box “c,” enter dates of Michigan residency in 2014.

Enter dates as MM-DD-YYYY (Example: 04-15-2014).

Check one.

Check all that apply.

a.

Single

a.

Resident

FILER

SPOUSE

2014

2014

FROM:

Married filing jointly

b.

b.

Nonresident

2014

2014

TO:

Married filing separately

c.

c.

Part-Year Resident *

(Attach Form 5049)

8. Homestead Status

Check here if the taxable value of your homestead includes unoccupied farmland classified as agricultural by your assessor.

9. Homeowners: Enter the 2014 taxable value of your homestead (see instructions). If you did not

check box 8 above and your taxable value is greater than $135,000, STOP; you are not eligible.

Farmers: enter the taxable value of your homestead, including eligible unoccupied farmland .............

9.

00

10. Property Taxes levied on your home for 2014 (see instructions) or amount from line 51, 56 and/or 57 10.

00

11. Renters: Enter rent you paid for 2014 from line 53 and/or 55 ...............

11.

00

12. Multiply line 11 by 20% (0.20) ................................................................................................................ 12.

00

13. Total. Add lines 10 and 12 .................................................................................................................... 13.

00

TOTAL HOUSEHOLD RESOURCES. If filing a joint return, include income from both spouses.

If married filing separately, you must attach Form 5049 available on Treasury’s Web site.

14. Wages, salaries, tips, sick, strike

21. Social Security, SSI, and/or

railroad retirement benefits. ..

and SUB pay, etc. .........................

14.

00

21.

00

15. All interest and dividend income

22. Child support and foster

(including nontaxable interest)......

15.

00

parent payments. .................. 22.

00

16. Net business income (including net

23. Unemployment

farm income). If negative enter “0”

16.

00

compensation. ...................... 23.

00

17. Net royalty or rent income.

24. Gifts or expenses paid on

If negative enter “0”. .....................

17.

00

your behalf. ........................... 24.

00

18. Retirement pension, annuity, and

25. Other nontaxable income

IRA benefits. .................................

18.

00

Describe: _______________ 25.

00

19. Capital gains less capital losses,

Workers’/veterans’ disability

26.

compensation/pension benefits

(see instructions). .........................

19.

00

26.

00

27. FIP and other DHS benefits

20. Alimony and other taxable income

Describe: ___________________

20.

00

27.

00

(Do not include food assistance)

28. SUBTOTAL. Add lines 14 through 27 ............................................................................. SUBTOTAL

28.

00

Continue on page 2. This form cannot be

+

0000 2014 25 01 27 9

processed if pages 2 and 3 are not completed and attached.

1

1 2

2 3

3