Form 4918 To 4920 - Michigan Flow-Through Withholding - 2014

ADVERTISEMENT

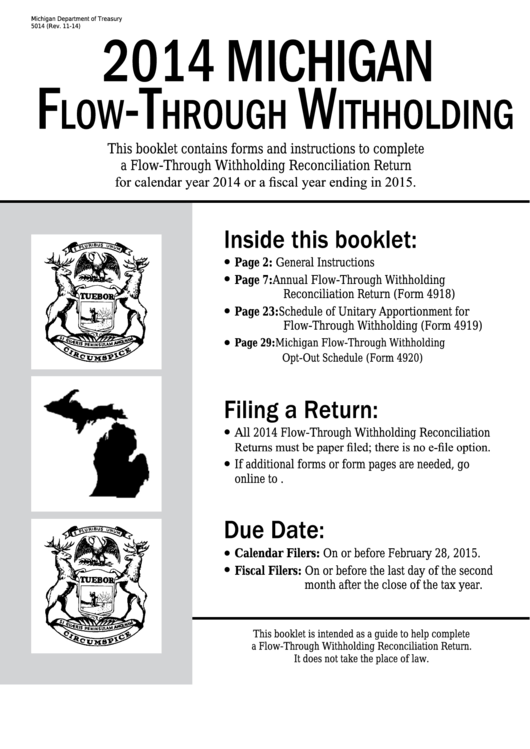

Michigan Department of Treasury

2014 Michigan

5014 (Rev. 11-14)

F

-T

w

low

hrough

iThholding

This booklet contains forms and instructions to complete

a Flow-Through Withholding Reconciliation Return

for calendar year 2014 or a fiscal year ending in 2015.

Inside this booklet:

l

Page 2: General Instructions

l

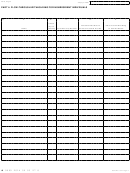

Page 7: Annual Flow-Through Withholding

Reconciliation Return (Form 4918)

l

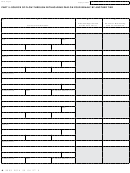

Page 23: Schedule of Unitary Apportionment for

Flow-Through Withholding (Form 4919)

l

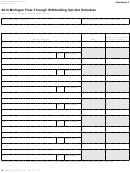

Page 29: Michigan Flow-Through Withholding

Opt-Out Schedule (Form 4920)

Filing a Return:

l

All 2014 Flow-Through Withholding Reconciliation

Returns must be paper filed; there is no e-file option.

l

If additional forms or form pages are needed, go

online to

Due Date:

l

Calendar Filers: On or before February 28, 2015.

l

Fiscal Filers: On or before the last day of the second

month after the close of the tax year.

This booklet is intended as a guide to help complete

a Flow-Through Withholding Reconciliation Return.

It does not take the place of law.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32