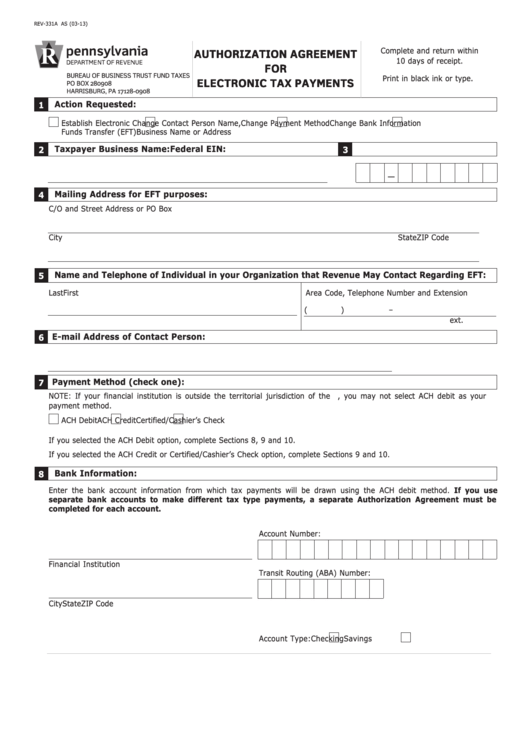

Form Rev-331a As - Authorization Agreement For Electronic Tax Payments

ADVERTISEMENT

REV-331A AS (03-13)

Complete and return within

AUTHORIZATION AGREEMENT

10 days of receipt.

FOR

BUREAU OF BUSINESS TRUST FUND TAXES

Print in black ink or type.

ELECTRONIC TAX PAYMENTS

PO BOX 280908

HARRISBURG, PA 17128-0908

Action Requested:

1

Establish Electronic

Change Contact Person Name,

Change Payment Method

Change Bank Information

Funds Transfer (EFT)

Business Name or Address

Taxpayer Business Name:

Federal EIN:

2

3

_

Mailing Address for EFT purposes:

4

C/O and Street Address or PO Box

City

State

ZIP Code

Name and Telephone of Individual in your Organization that Revenue May Contact Regarding EFT:

5

Last

First

M.I.

Area Code, Telephone Number and Extension

(

)

–

ext.

E-mail Address of Contact Person:

6

Payment Method (check one):

7

NOTE: If your financial institution is outside the territorial jurisdiction of the U.S., you may not select ACH debit as your

payment method.

ACH Debit

ACH Credit

Certified/Cashier’s Check

If you selected the ACH Debit option, complete Sections 8, 9 and 10.

If you selected the ACH Credit or Certified/Cashier’s Check option, complete Sections 9 and 10.

Bank Information:

8

Enter the bank account information from which tax payments will be drawn using the ACH debit method. If you use

separate bank accounts to make different tax type payments, a separate Authorization Agreement must be

completed for each account.

Account Number:

Financial Institution

Transit Routing (ABA) Number:

City

State

ZIP Code

Account Type:

Checking

Savings

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2