Schedule Os-114a To Form Os-114 - Sales And Use Tax Return

ADVERTISEMENT

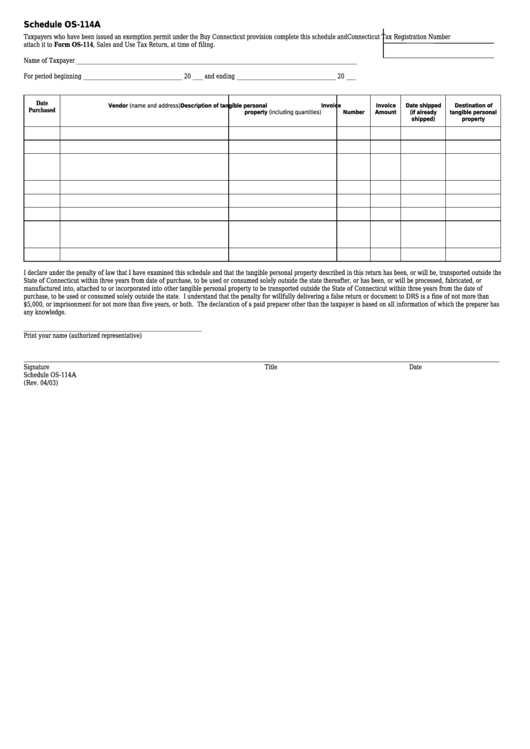

Schedule OS-114A

Taxpayers who have been issued an exemption permit under the Buy Connecticut provision complete this schedule and

Connecticut Tax Registration Number

attach it to Form OS-114, Sales and Use Tax Return, at time of filing.

Name of Taxpayer __________________________________________________________________________________

For period beginning _____________________________ 20 ___ and ending _____________________________ 20 ___

Date

Vendor (name and address)

Description of tangible personal

Invoice

Invoice

Date shipped

Destination of

Purchased

property (including quantities)

Number

Amount

(if already

tangible personal

shipped)

property

I declare under the penalty of law that I have examined this schedule and that the tangible personal property described in this return has been, or will be, transported outside the

State of Connecticut within three years from date of purchase, to be used or consumed solely outside the state thereafter, or has been, or will be processed, fabricated, or

manufactured into, attached to or incorporated into other tangible personal property to be transported outside the State of Connecticut within three years from the date of

purchase, to be used or consumed solely outside the state. I understand that the penalty for willfully delivering a false return or document to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has

any knowledge.

____________________________________________________

Print your name (authorized representative)

Signature

Title

Date

Schedule OS-114A

(Rev. 04/03)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1