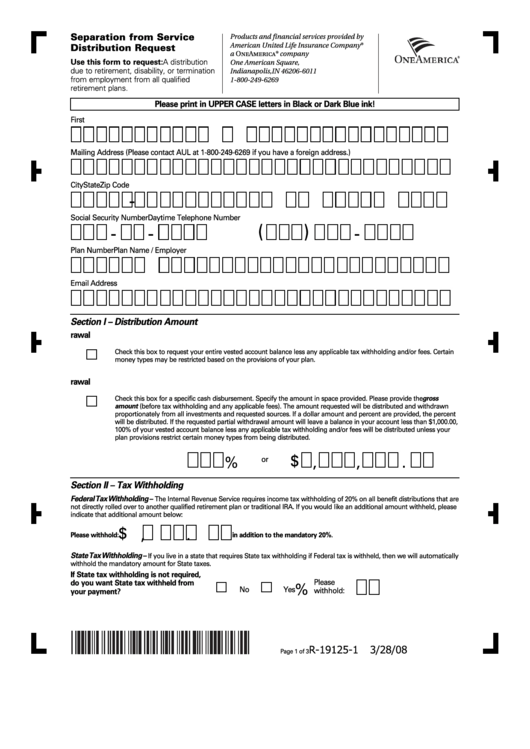

Separation from Service

Products and financial services provided by

American United Life Insurance Company

®

Distribution Request

a OneAmerica

®

company

Use this form to request: A distribution

One American Square, P .O. Box 6011

due to retirement, disability, or termination

Indianapolis, IN 46206-6011

from employment from all qualified

1-800-249-6269

retirement plans.

Please print in UPPER CASE letters in Black or Dark Blue ink!

First Name

M.I.

Last Name

Mailing Address (Please contact AUL at 1-800-249-6269 if you have a foreign address.)

City

State

Zip Code

-

Social Security Number

Daytime Telephone Number

(

)

-

-

-

Plan Number

Plan Name / Employer

Email Address

Section I – Distribution Amount

A. Full Withdrawal

Check this box to request your entire vested account balance less any applicable tax withholding and/or fees. Certain

money types may be restricted based on the provisions of your plan.

B. Partial Withdrawal

Check this box for a specific cash disbursement. Specify the amount in space provided. Please provide the gross

amount (before tax withholding and any applicable fees). The amount requested will be distributed and withdrawn

proportionately from all investments and requested sources. If a dollar amount and percent are provided, the percent

will be distributed. If the requested partial withdrawal amount will leave a balance in your account less than $1,000.00,

100% of your vested account balance less any applicable tax withholding and/or fees will be distributed unless your

plan provisions restrict certain money types from being distributed.

$ ,

%

or

,

.

Section II – Tax Withholding

Federal Tax Withholding –

The Internal Revenue Service requires income tax withholding of 20% on all benefit distributions that are

not directly rolled over to another qualified retirement plan or traditional IRA. If you would like an additional amount withheld, please

indicate that additional amount below:

$ ,

.

Please withhold:

in addition to the mandatory 20%.

State Tax Withholding –

If you live in a state that requires State tax withholding if Federal tax is withheld, then we will automatically

withhold the mandatory amount for State taxes.

If State tax withholding is not required,

Please

do you want State tax withheld from

%

No

Yes

withhold:

your payment?

R-19125-1

3/28/08

Page 1 of 3

1

1 2

2 3

3