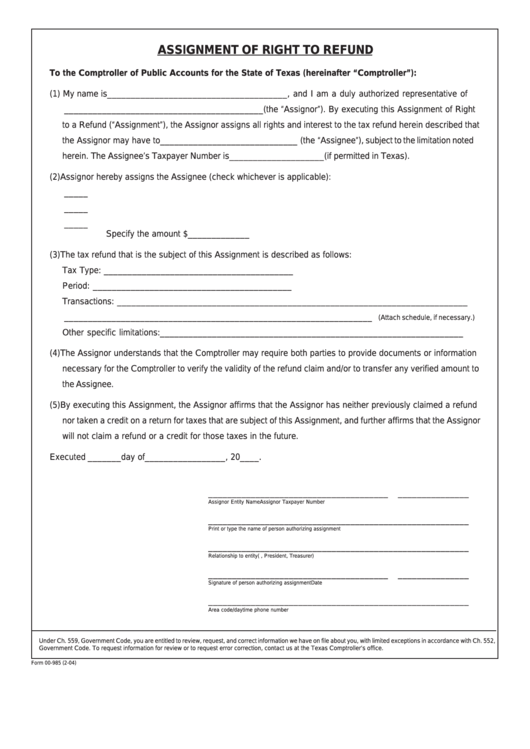

ASSIGNMENT OF RIGHT TO REFUND

To the Comptroller of Public Accounts for the State of Texas (hereinafter “Comptroller”):

(1) My name is ______________________________________ , and I am a duly authorized representative of

__________________________________________ (the “Assignor”). By executing this Assignment of Right

to a Refund (“Assignment”), the Assignor assigns all rights and interest to the tax refund herein described that

the Assignor may have to _____________________________ (the “Assignee”), subject to the limitation noted

herein. The Assignee’s Taxpayer Number is ____________________ (if permitted in Texas).

(2) Assignor hereby assigns the Assignee (check whichever is applicable):

_____ a. The right to file a request for a refund and to receive the refund.

_____ b. The right to receive the refund only.

_____ c. The right to receive the credit that is subject to Rider 11 limitations.

Specify the amount $ _____________

(3) The tax refund that is the subject of this Assignment is described as follows:

Tax Type: ________________________________________

Period: __________________________________________

Transactions: __________________________________________________________________________

_________________________________________________________________

(Attach schedule, if necessary.)

Other specific limitations: ________________________________________________________________

(4) The Assignor understands that the Comptroller may require both parties to provide documents or information

necessary for the Comptroller to verify the validity of the refund claim and/or to transfer any verified amount to

the Assignee.

(5) By executing this Assignment, the Assignor affirms that the Assignor has neither previously claimed a refund

nor taken a credit on a return for taxes that are subject of this Assignment, and further affirms that the Assignor

will not claim a refund or a credit for those taxes in the future.

Executed _______ day of _________________ , 20 ____ .

______________________________________

_______________

Assignor Entity Name

Assignor Taxpayer Number

_______________________________________________________

Print or type the name of person authorizing assignment

_______________________________________________________

Relationship to entity (i.e., President, Treasurer)

______________________________________

_______________

Signature of person authorizing assignment

Date

_______________________________________________________

Area code/daytime phone number

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance with Ch. 552,

Government Code. To request information for review or to request error correction, contact us at the Texas Comptroller’s office.

Form 00-985 (2-04)

1

1