Reset Form

Print Form

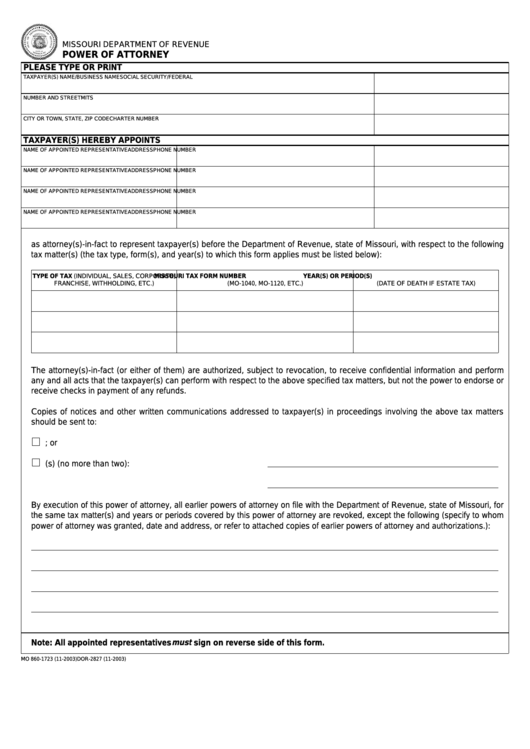

MISSOURI DEPARTMENT OF REVENUE

POWER OF ATTORNEY

PLEASE TYPE OR PRINT

TAXPAYER(S) NAME/BUSINESS NAME

SOCIAL SECURITY/FEDERAL I.D. NUMBER

NUMBER AND STREET

MITS I.D. NUMBER

CITY OR TOWN, STATE, ZIP CODE

CHARTER NUMBER

TAXPAYER(S) HEREBY APPOINTS

NAME OF APPOINTED REPRESENTATIVE

ADDRESS

PHONE NUMBER

NAME OF APPOINTED REPRESENTATIVE

ADDRESS

PHONE NUMBER

NAME OF APPOINTED REPRESENTATIVE

ADDRESS

PHONE NUMBER

NAME OF APPOINTED REPRESENTATIVE

ADDRESS

PHONE NUMBER

as attorney(s)-in-fact to represent taxpayer(s) before the Department of Revenue, state of Missouri, with respect to the following

tax matter(s) (the tax type, form(s), and year(s) to which this form applies must be listed below):

TYPE OF TAX (INDIVIDUAL, SALES, CORPORATE,

MISSOURI TAX FORM NUMBER

YEAR(S) OR PERIOD(S)

FRANCHISE, WITHHOLDING, ETC.)

(MO-1040, MO-1120, ETC.)

(DATE OF DEATH IF ESTATE TAX)

The attorney(s)-in-fact (or either of them) are authorized, subject to revocation, to receive confidential information and perform

any and all acts that the taxpayer(s) can perform with respect to the above specified tax matters, but not the power to endorse or

receive checks in payment of any refunds.

Copies of notices and other written communications addressed to taxpayer(s) in proceedings involving the above tax matters

should be sent to:

1. the representative first named above; or

2. the following named representative(s) (no more than two):

By execution of this power of attorney, all earlier powers of attorney on file with the Department of Revenue, state of Missouri, for

the same tax matter(s) and years or periods covered by this power of attorney are revoked, except the following (specify to whom

power of attorney was granted, date and address, or refer to attached copies of earlier powers of attorney and authorizations.):

Note: All appointed representatives must sign on reverse side of this form.

MO 860-1723 (11-2003)

DOR-2827 (11-2003)

1

1 2

2