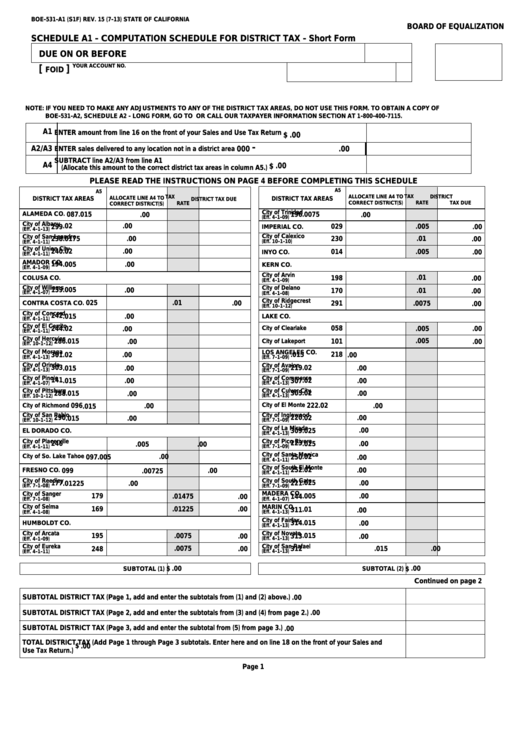

Form Boe-531 - Schedule A1 - Computation Schedule For District Tax - Short Form

ADVERTISEMENT

BOE-531-A1 (S1F) REV. 15 (7-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SCHEDULE A1 - COMPUTATION SCHEDULE FOR DISTRICT TAX - Short Form

DUE ON OR BEFORE

YOUR ACCOUNT NO.

[

]

FOID

NOTE: IF YOU NEED TO MAKE ANY ADJUSTMENTS TO ANY OF THE DISTRICT TAX AREAS, DO NOT USE THIS FORM. TO OBTAIN A COPY OF

BOE-531-A2, SCHEDULE A2 - LONG FORM, GO TO OR CALL OUR TAXPAYER INFORMATION SECTION AT 1-800-400-7115.

A1

ENTER amount from line 16 on the front of your Sales and Use Tax Return

$

.00

-

A2/A3

ENTER sales delivered to any location not in a district area

.00

000

SUBTRACT line A2/A3 from line A1

A4

.00

$

(Allocate this amount to the correct district tax areas in column A5.)

PLEASE READ THE INSTRUCTIONS ON PAGE 4 BEFORE COMPLETING THIS SCHEDULE

A5

A5

TAX

ALLOCATE LINE A4 TO

DISTRICT

TAX

ALLOCATE LINE A4 TO

DISTRICT TAX AREAS

DISTRICT TAX AREAS

DISTRICT TAX DUE

CORRECT DISTRICT(S)

RATE

TAX DUE

RATE

CORRECT DISTRICT(S)

City of Trinidad

ALAMEDA CO.

087

.015

.00

196

.0075

.00

(Eff. 4-1-09)

City of Albany

.00

.02

029

.005

.00

299

IMPERIAL CO.

(Eff. 4-1-13)

City of Calexico

City of San Leandro

.00

.00

230

.01

238

.0175

(Eff. 10-1-10)

(Eff. 4-1-11)

City of Union City

.00

240

.02

014

.005

.00

INYO CO.

(Eff. 4-1-11)

AMADOR CO.

194

.00

.005

KERN CO.

(Eff. 4-1-09)

City of Arvin

.01

.00

COLUSA CO.

198

(Eff. 4-1-09)

City of Williams

City of Delano

139

.005

.00

.01

.00

170

(Eff. 4-1-07)

(Eff. 4-1-08)

City of Ridgecrest

025

.01

.00

CONTRA COSTA CO.

291

.0075

.00

(Eff. 10-1-12)

City of Concord

242

.00

.015

LAKE CO.

(Eff. 4-1-11)

City of El Cerrito

244

.02

.00

City of Clearlake

058

.00

.005

(Eff. 4-1-11)

City of Hercules

.00

City of Lakeport

101

.005

.00

286

.015

(Eff. 10-1-12)

City of Moraga

LOS ANGELES CO.

.00

301

.02

218

.015

.00

(Eff. 4-1-13)

(Eff. 7-1-09)

City of Orinda

City of Avalon

.00

.00

303

219

.02

.015

(Eff. 4-1-13)

(Eff. 7-1-09)

City of Commerce

City of Pinole

141

.00

.02

.00

.015

307

(Eff. 4-1-07)

(Eff. 4-1-13)

City of Pittsburg

City of Culver City

.00

305

.02

.00

288

.015

(Eff. 4-1-13)

(Eff. 10-1-12)

.00

City of El Monte

.00

City of Richmond

096

222

.02

.015

City of San Pablo

City of Inglewood

290

.00

220

.00

.015

.02

(Eff. 10-1-12)

(Eff. 7-1-09)

City of La Mirada

.00

309

.025

EL DORADO CO.

(Eff. 4-1-13)

City of Placerville

City of Pico Rivera

246

.00

223

.00

.005

.025

(Eff. 4-1-11)

(Eff. 7-1-09)

City of Santa Monica

.00

City of So. Lake Tahoe

.02

.00

097

.005

250

(Eff. 4-1-11)

City of South El Monte

.00

.00

252

.02

FRESNO CO.

099

.00725

(Eff. 4-1-11)

City of Reedley

City of South Gate

221

.025

.00

177

.00

.01225

(Eff. 7-1-08)

(Eff. 7-1-09)

City of Sanger

MADERA CO.

179

.005

.00

.01475

.00

144

(Eff. 7-1-08)

(Eff. 4-1-07)

City of Selma

MARIN CO.

.00

169

.01225

311

.01

.00

(Eff. 4-1-08)

(Eff. 4-1-13)

City of Fairfax

.00

314

.015

HUMBOLDT CO.

(Eff. 4-1-13)

City of Arcata

City of Novato

195

.0075

.00

.015

.00

313

(Eff. 4-1-09)

(Eff. 4-1-13)

City of Eureka

City of San Rafael

.0075

.00

.015

.00

248

312

(Eff. 4-1-11)

(Eff. 4-1-13)

$

.00

.00

$

SUBTOTAL (1)

SUBTOTAL (2)

Continued on page 2

SUBTOTAL DISTRICT TAX (Page 1, add and enter the subtotals from (1) and (2) above.)

.00

SUBTOTAL DISTRICT TAX (Page 2, add and enter the subtotals from (3) and (4) from page 2.)

.00

SUBTOTAL DISTRICT TAX (Page 3, add and enter the subtotal from (5) from page 3.)

.00

TOTAL DISTRICT TAX (Add Page 1 through Page 3 subtotals. Enter here and on line 18 on the front of your Sales and

$

.00

Use Tax Return.)

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4