Instructions - Sale Of Rhode Island Real Estate By Nonresidents

ADVERTISEMENT

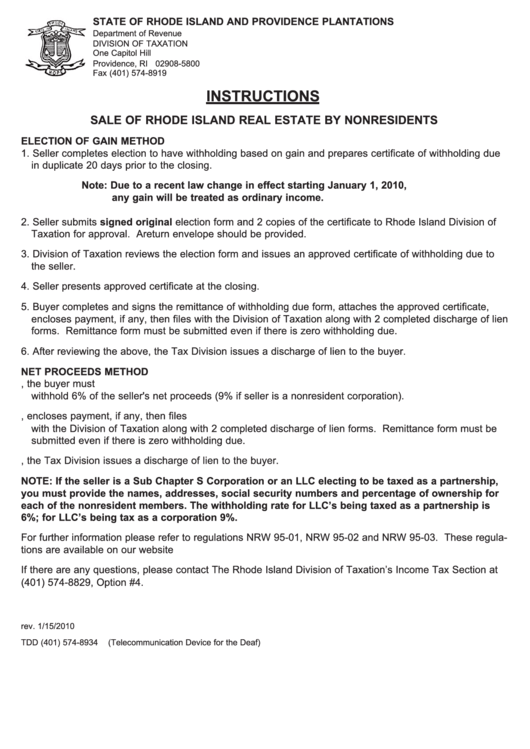

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

Department of Revenue

DIVISION OF TAXATION

One Capitol Hill

Providence, RI 02908-5800

Fax (401) 574-8919

INSTRUCTIONS

SALE OF RHODE ISLAND REAL ESTATE BY NONRESIDENTS

ELECTION OF GAIN METHOD

1. Seller completes election to have withholding based on gain and prepares certificate of withholding due

in duplicate 20 days prior to the closing.

Note: Due to a recent law change in effect starting January 1, 2010,

any gain will be treated as ordinary income.

2. Seller submits signed original election form and 2 copies of the certificate to Rhode Island Division of

Taxation for approval. A return envelope should be provided.

3. Division of Taxation reviews the election form and issues an approved certificate of withholding due to

the seller.

4. Seller presents approved certificate at the closing.

5. Buyer completes and signs the remittance of withholding due form, attaches the approved certificate,

encloses payment, if any, then files with the Division of Taxation along with 2 completed discharge of lien

forms. Remittance form must be submitted even if there is zero withholding due.

6. After reviewing the above, the Tax Division issues a discharge of lien to the buyer.

NET PROCEEDS METHOD

1. If an approved certificate of withholding due has not been obtained prior to the closing, the buyer must

withhold 6% of the seller's net proceeds (9% if seller is a nonresident corporation).

2. Buyer completes and signs the remittance of withholding due form, encloses payment, if any, then files

with the Division of Taxation along with 2 completed discharge of lien forms. Remittance form must be

submitted even if there is zero withholding due.

3. After reviewing the above, the Tax Division issues a discharge of lien to the buyer.

NOTE: If the seller is a Sub Chapter S Corporation or an LLC electing to be taxed as a partnership,

you must provide the names, addresses, social security numbers and percentage of ownership for

each of the nonresident members. The withholding rate for LLC’s being taxed as a partnership is

6%; for LLC’s being tax as a corporation 9%.

For further information please refer to regulations NRW 95-01, NRW 95-02 and NRW 95-03. These regula-

tions are available on our website

If there are any questions, please contact The Rhode Island Division of Taxation’s Income Tax Section at

(401) 574-8829, Option #4.

rev. 1/15/2010

TDD (401) 574-8934

(Telecommunication Device for the Deaf)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1