Form Ri - 71.3 - Remittance Of Withholding On Sale Of Real Estate By Nonresident

ADVERTISEMENT

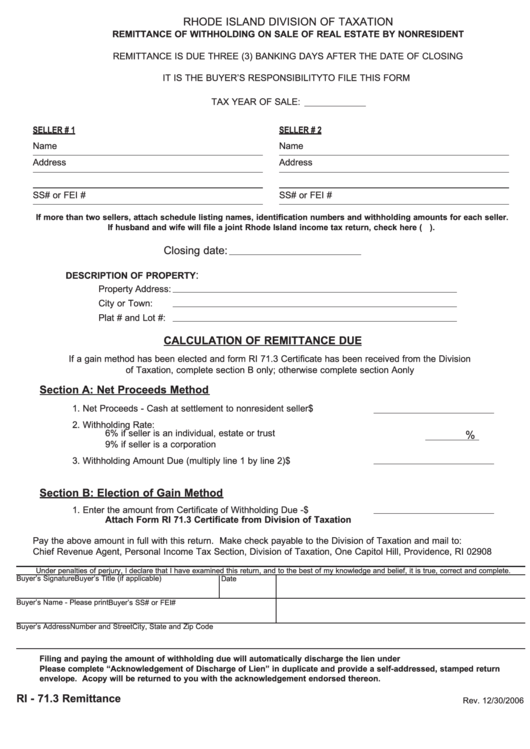

RHODE ISLAND DIVISION OF TAXATION

REMITTANCE OF WITHHOLDING ON SALE OF REAL ESTATE BY NONRESIDENT

R.I.G.L.. 44-30-71.3 and Regulations

REMITTANCE IS DUE THREE (3) BANKING DAYS AFTER THE DATE OF CLOSING

IT IS THE BUYER’S RESPONSIBILITY TO FILE THIS FORM

TAX YEAR OF SALE:

SELLER # 1

SELLER # 2

Name

Name

Address

Address

SS# or FEI #

SS# or FEI #

If more than two sellers, attach schedule listing names, identification numbers and withholding amounts for each seller.

If husband and wife will file a joint Rhode Island income tax return, check here ( ).

Closing date:

:

DESCRIPTION OF PROPERTY

Property Address:

City or Town:

Plat # and Lot #:

CALCULATION OF REMITTANCE DUE

If a gain method has been elected and form RI 71.3 Certificate has been received from the Division

of Taxation, complete section B only; otherwise complete section A only

Section A: Net Proceeds Method

1. Net Proceeds - Cash at settlement to nonresident seller

$

2. Withholding Rate:

6% if seller is an individual, estate or trust

%

9% if seller is a corporation

3. Withholding Amount Due (multiply line 1 by line 2)

$

Section B: Election of Gain Method

1. Enter the amount from Certificate of Withholding Due -

$

Attach Form RI 71.3 Certificate from Division of Taxation

Pay the above amount in full with this return. Make check payable to the Division of Taxation and mail to:

Chief Revenue Agent, Personal Income Tax Section, Division of Taxation, One Capitol Hill, Providence, RI 02908

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct and complete.

Buyer’s Signature

Buyer’s Title (if applicable)

Date

Buyer’s Name - Please print

Buyer’s SS# or FEI#

Buyer’s Address

Number and Street

City, State and Zip Code

Filing and paying the amount of withholding due will automatically discharge the lien under R.I.G.L. 44-30-71.3.

Please complete “Acknowledgement of Discharge of Lien” in duplicate and provide a self-addressed, stamped return

envelope. A copy will be returned to you with the acknowledgement endorsed thereon.

RI - 71.3 Remittance

Rev. 12/30/2006

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1