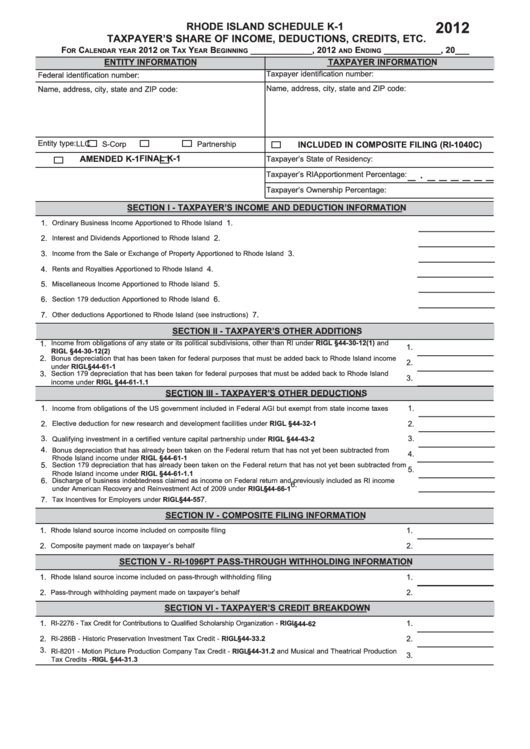

2012

RHODE ISLAND SCHEDULE K-1

TAXPAYER’S SHARE OF INCOME, DEDUCTIONS, CREDITS, ETC.

F

C

2012

T

Y

B

_____________, 2012

E

____________, 20___

OR

ALENDAR YEAR

OR

AX

EAR

EGINNING

AND

NDING

ENTITY INFORMATION

TAXPAYER INFORMATION

Taxpayer identification number:

Federal identification number:

Name, address, city, state and ZIP code:

Name, address, city, state and ZIP code:

Entity type:

S-Corp

LLC

Partnership

INCLUDED IN COMPOSITE FILING (RI-1040C)

FINAL K-1

AMENDED K-1

Taxpayer’s State of Residency:

_ . _ _ _ _ _ _

Taxpayer’s RI Apportionment Percentage:

Taxpayer’s Ownership Percentage:

SECTION I - TAXPAYER’S INCOME AND DEDUCTION INFORMATION

1.

Ordinary Business Income Apportioned to Rhode Island ...............................................................................................

1.

2.

2.

Interest and Dividends Apportioned to Rhode Island ......................................................................................................

3.

Income from the Sale or Exchange of Property Apportioned to Rhode Island ...............................................................

3.

4.

4.

Rents and Royalties Apportioned to Rhode Island .........................................................................................................

5.

Miscellaneous Income Apportioned to Rhode Island ......................................................................................................

5.

6.

6.

Section 179 deduction Apportioned to Rhode Island ......................................................................................................

7.

Other deductions Apportioned to Rhode Island (see instructions) ..................................................................................

7.

SECTION II - TAXPAYER’S OTHER ADDITIONS

1.

Income from obligations of any state or its political subdivisions, other than RI under RIGL §44-30-12(1) and

1.

RIGL §44-30-12(2) ......................................................................................................................................................

2.

Bonus depreciation that has been taken for federal purposes that must be added back to Rhode Island income

2.

under RIGL §44-61-1 ..................................................................................................................................................

3.

Section 179 depreciation that has been taken for federal purposes that must be added back to Rhode Island

3.

income under RIGL §44-61-1.1 ..................................................................................................................................

SECTION III - TAXPAYER’S OTHER DEDUCTIONS

1.

Income from obligations of the US government included in Federal AGI but exempt from state income taxes ........

1.

2.

2.

Elective deduction for new research and development facilities under RIGL §44-32-1 .............................................

3.

3.

Qualifying investment in a certified venture capital partnership under RIGL §44-43-2 ..............................................

4.

Bonus depreciation that has already been taken on the Federal return that has not yet been subtracted from

4.

Rhode Island income under RIGL §44-61-1...............................................................................................................

5.

Section 179 depreciation that has already been taken on the Federal return that has not yet been subtracted from

5.

Rhode Island income under RIGL §44-61-1.1............................................................................................................

6.

Discharge of business indebtedness claimed as income on Federal return and previously included as RI income

6.

under American Recovery and Reinvestment Act of 2009 under RIGL §44-66-1...........................................................

7.

7.

Tax Incentives for Employers under RIGL §44-55...........................................................................................................

SECTION IV - COMPOSITE FILING INFORMATION

1.

1.

Rhode Island source income included on composite filing .............................................................................................

2.

2.

Composite payment made on taxpayer’s behalf .............................................................................................................

SECTION V - RI-1096PT PASS-THROUGH WITHHOLDING INFORMATION

1.

1.

Rhode Island source income included on pass-through withholding filing .....................................................................

2.

Pass-through withholding payment made on taxpayer’s behalf ......................................................................................

2.

SECTION VI - TAXPAYER’S CREDIT BREAKDOWN

1.

1.

RI-2276 - Tax Credit for Contributions to Qualified Scholarship Organization - RIGL §44-62 ...........................................

2.

2.

RI-286B - Historic Preservation Investment Tax Credit - RIGL §44-33.2 .....................................................................

3.

RI-8201 - Motion Picture Production Company Tax Credit - RIGL §44-31.2 and Musical and Theatrical Production

3.

Tax Credits - RIGL §44-31.3.........................................................................................................................................

1

1 2

2