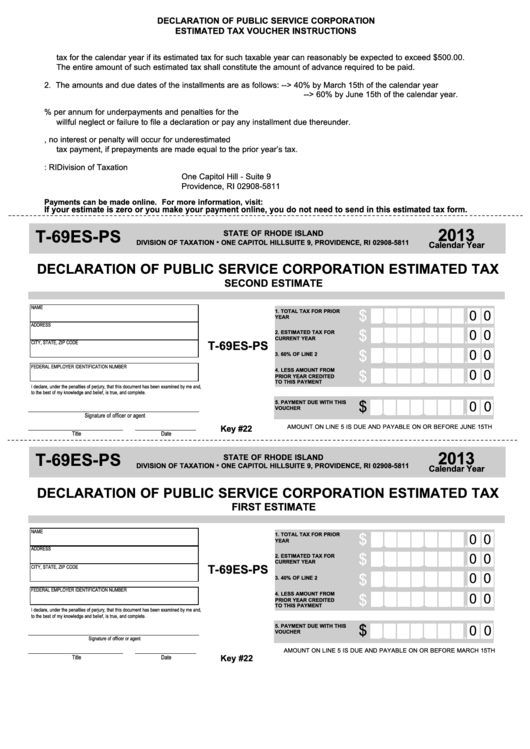

DECLARATION OF PUBLIC SERVICE CORPORATION

ESTIMATED TAX VOUCHER INSTRUCTIONS

1. Every public service corporation liable for the gross earnings public service tax shall file a declaration of its estimated

tax for the calendar year if its estimated tax for such taxable year can reasonably be expected to exceed $500.00.

The entire amount of such estimated tax shall constitute the amount of advance required to be paid.

2. The amounts and due dates of the installments are as follows:

--> 40% by March 15th of the calendar year

--> 60% by June 15th of the calendar year.

3. Every public service corporation is subject to an assessment of 18% per annum for underpayments and penalties for the

willful neglect or failure to file a declaration or pay any installment due thereunder.

4. When there is not an increase in the tax rate from one year to the next, no interest or penalty will occur for underestimated

tax payment, if prepayments are made equal to the prior year’s tax.

5. Mail voucher and payment to:

RI Division of Taxation

One Capitol Hill - Suite 9

Providence, RI 02908-5811

Payments can be made online. For more information, visit: https://

If your estimate is zero or you make your payment online, you do not need to send in this estimated tax form.

2013

T-69ES-PS

STATE OF RHODE ISLAND

DIVISION OF TAXATION * ONE CAPITOL HILL SUITE 9, PROVIDENCE, RI 02908-5811

Calendar Year

DECLARATION OF PUBLIC SERVICE CORPORATION ESTIMATED TAX

SECOND ESTIMATE

NAME

1. TOTAL TAX FOR PRIOR

$

0 0

YEAR

ADDRESS

$

0 0

2. ESTIMATED TAX FOR

CURRENT YEAR

CITY, STATE, ZIP CODE

T-69ES-PS

0 0

$

3. 60% OF LINE 2

FEDERAL EMPLOYER IDENTIFICATION NUMBER

4. LESS AMOUNT FROM

0 0

$

PRIOR YEAR CREDITED

TO THIS PAYMENT

I declare, under the penalties of perjury, that this document has been examined by me and,

to the best of my knowledge and belief, is true, and complete.

5. PAYMENT DUE WITH THIS

$

0 0

VOUCHER

Signature of officer or agent

AMOUNT ON LINE 5 IS DUE AND PAYABLE ON OR BEFORE JUNE 15TH

Key #22

Title

Date

2013

T-69ES-PS

STATE OF RHODE ISLAND

DIVISION OF TAXATION * ONE CAPITOL HILL SUITE 9, PROVIDENCE, RI 02908-5811

Calendar Year

DECLARATION OF PUBLIC SERVICE CORPORATION ESTIMATED TAX

FIRST ESTIMATE

NAME

1. TOTAL TAX FOR PRIOR

$

0 0

YEAR

ADDRESS

$

2. ESTIMATED TAX FOR

0 0

CURRENT YEAR

CITY, STATE, ZIP CODE

T-69ES-PS

0 0

$

3. 40% OF LINE 2

FEDERAL EMPLOYER IDENTIFICATION NUMBER

4. LESS AMOUNT FROM

0 0

$

PRIOR YEAR CREDITED

TO THIS PAYMENT

I declare, under the penalties of perjury, that this document has been examined by me and,

to the best of my knowledge and belief, is true, and complete.

5. PAYMENT DUE WITH THIS

$

0 0

VOUCHER

Signature of officer or agent

AMOUNT ON LINE 5 IS DUE AND PAYABLE ON OR BEFORE MARCH 15TH

Title

Date

Key #22

1

1