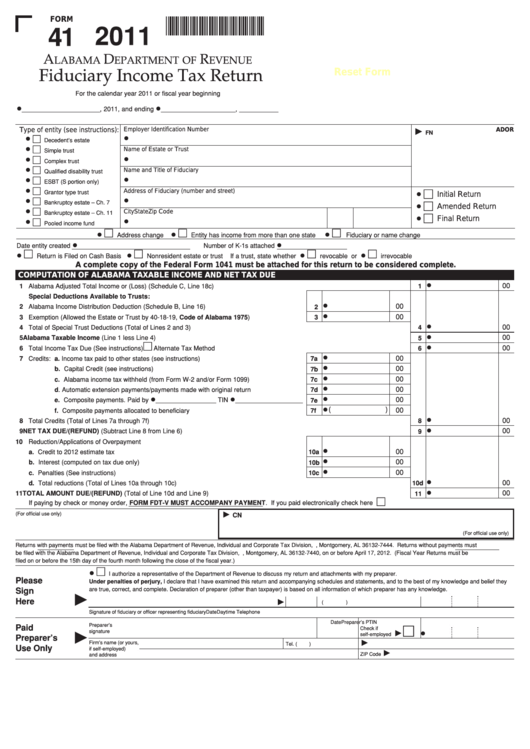

FORM

11000141

41 2011

A

D

R

LABAMA

EPARTMENT OF

EVENUE

Reset Form

Fiduciary Income Tax Return

For the calendar year 2011 or fiscal year beginning

•______________________, 2011, and ending •_____________________, ___________

Type of entity (see instructions):

Employer Identification Number

ADOR

FN

•

•

Decedent’s estate

•

Name of Estate or Trust

Simple trust

•

•

Complex trust

•

Name and Title of Fiduciary

Qualified disability trust

•

•

ESBT (S portion only)

•

Address of Fiduciary (number and street)

Grantor type trust

•

Initial Return

•

•

Bankruptcy estate – Ch. 7

•

Amended Return

•

City

State

Zip Code

Bankruptcy estate – Ch. 11

•

Final Return

•

•

Pooled income fund

•

•

•

Address change

Entity has income from more than one state

Fiduciary or name change

Date entity created •

Number of K-1s attached •

•

•

If a trust, state whether •

revocable or •

Return is Filed on Cash Basis

Nonresident estate or trust

irrevocable

A complete copy of the Federal Form 1041 must be attached for this return to be considered complete.

COMPUTATION OF ALABAMA TAXABLE INCOME AND NET TAX DUE

•

00

1 Alabama Adjusted Total Income or (Loss) (Schedule C, Line 18c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

Special Deductions Available to Trusts:

•

00

2 Alabama Income Distribution Deduction (Schedule B, Line 16). . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

•

00

3 Exemption (Allowed the Estate or Trust by 40-18-19, Code of Alabama 1975) . . . . . . . . . . . . . . . .

3

•

00

4 Total of Special Trust Deductions (Total of Lines 2 and 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

•

00

5 Alabama Taxable Income (Line 1 less Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

•

00

6 Total Income Tax Due (See instructions) . . . . . . . . . . . .

Alternate Tax Method . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

•

00

7 Credits: a. Income tax paid to other states (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

•

00

b. Capital Credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7b

•

00

c. Alabama income tax withheld (from Form W-2 and/or Form 1099) . . . . . . . . . . . . . . . .

7c

•

00

d. Automatic extension payments/payments made with original return . . . . . . . . . . . . . . .

7d

•

e. Composite payments. Paid by •_________________ TIN •___________________

00

7e

•

(

)

00

f. Composite payments allocated to beneficiary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7f

•

00

8 Total Credits (Total of Lines 7a through 7f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

•

00

9 NET TAX DUE/(REFUND) (Subtract Line 8 from Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Reduction/Applications of Overpayment

•

00

a. Credit to 2012 estimate tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10a

•

00

b. Interest (computed on tax due only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10b

•

00

c. Penalties (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10c

•

00

d. Total reductions (Total of Lines 10a through 10c). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10d

•

00

11 TOTAL AMOUNT DUE/(REFUND) (Total of Line 10d and Line 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

If paying by check or money order, FORM FDT-V MUST ACCOMPANY PAYMENT. If you paid electronically check here

(For official use only)

CN

(For official use only)

Returns with payments must be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327444, Montgomery, AL 36132-7444. Returns without payments must

be filed with the Alabama Department of Revenue, Individual and Corporate Tax Division, P.O. Box 327440, Montgomery, AL 36132-7440, on or before April 17, 2012. (Fiscal Year Returns must be

filed on or before the 15th day of the fourth month following the close of the fiscal year.)

•

I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Please

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief they

Sign

are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here

(

)

Signature of fiduciary or officer representing fiduciary

Date

Daytime Telephone No.

Social Security Number

Date

Preparer’s PTIN

Preparer’s

Paid

Check if

signature

•

self-employed

Preparer’s

Firm’s name (or yours,

Tel. (

)

E.I. No.

Use Only

if self-employed)

ZIP Code

and address

1

1 2

2 3

3 4

4