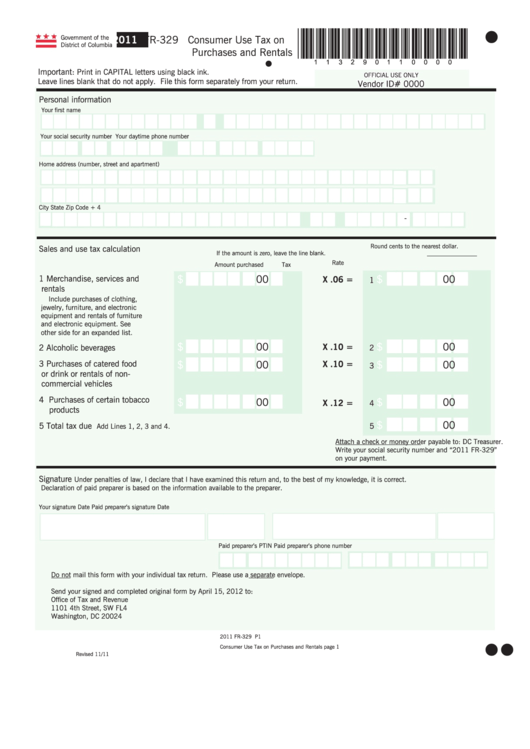

Form Fr-329 - Consumer Use Tax On Purchases And Rentals - 2011

ADVERTISEMENT

l

*113290110000*

2011

FR-329 Consumer Use Tax on

Government of the

District of Columbia

Purchases and Rentals

l

Important:

Print in CAPITAL letters using black ink.

OFFICIAL USE ONLY

Leave lines blank that do not apply. File this form separately from your return.

Vendor ID# 0000

Personal information

Your first name

M.I.

Last name

Your social security number

Your daytime phone number

Home address (number, street and apartment)

City

State

Zip Code + 4

-

Round cents to the nearest dollar.

Sales and use tax calculation

If the amount is zero, leave the line blank.

Rate

Amount purchased

Tax

.00

.00

$

$

1 Merchandise, services and

X .06 =

1

rentals

Include purchases of clothing,

jewelry, furniture, and electronic

equipment and rentals of furniture

and electronic equipment. See

other side for an expanded list.

$

.00

$

.00

X .10 =

2 Alcoholic beverages

2

3 Purchases of catered food

$

.00

$

.00

X .10 =

3

or drink or rentals of non-

commercial vehicles

4 Purchases of certain tobacco

.00

.00

$

$

X .12 =

4

products

$

.00

5 Total tax due

5

Add Lines 1, 2, 3 and 4.

Attach a check or money order payable to: DC Treasurer.

Write your social security number and “2011 FR-329”

on your payment.

Signature

Under penalties of law, I declare that I have examined this return and, to the best of my knowledge, it is correct.

Declaration of paid preparer is based on the information available to the preparer.

Your signature

Date

Paid preparer’s signature

Date

Paid preparer’s PTIN

Paid preparer’s phone number

Do not mail this form with your individual tax return. Please use a separate envelope.

Send your signed and completed original form by April 15, 2012 to:

Office of Tax and Revenue

1101 4th Street, SW FL4

Washington, DC 20024

2011 FR-329 P1

l

l

Consumer Use Tax on Purchases and Rentals page 1

Revised 11/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2