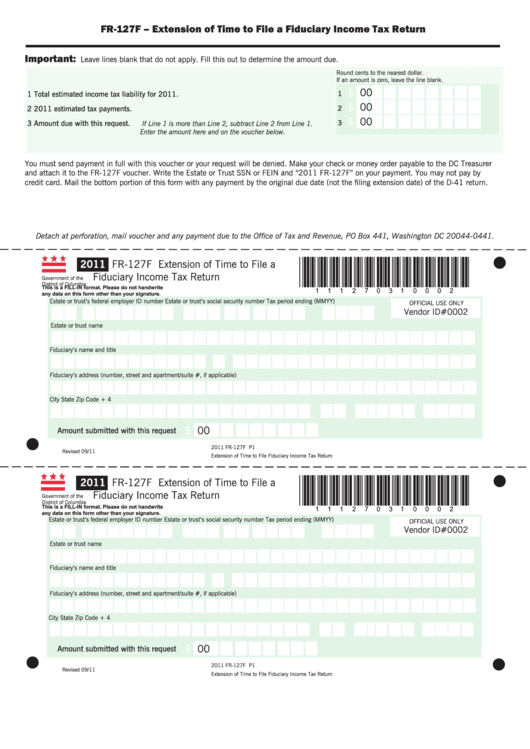

FR-127F – Extension of Time to File a Fiduciary Income Tax Return

Important:

Leave lines blank that do not apply. Fill this out to determine the amount due.

Round cents to the nearest dollar.

If an amount is zero, leave the line blank.

$

.00

1 Total estimated income tax liability for 2011.

1

$

.00

2 2011 estimated tax payments.

2

$

.00

3 Amount due with this request.

3

If Line 1 is more than Line 2, subtract Line 2 from Line 1.

.

Enter the amount here and on the voucher below

You must send payment in full with this voucher or your request will be denied. Make your check or money order payable to the DC Treasurer

and attach it to the FR-127F voucher. Write the Estate or Trust SSN or FEIN and “2011 FR-127F” on your payment. You may not pay by

credit card. Mail the bottom portion of this form with any payment by the original due date (not the filing extension date) of the D-41 return.

Detach at perforation, mail voucher and any payment due to the Office of Tax and Revenue, PO Box 441, Washington DC 20044-0441.

l

Print

*111270310002*

2011

FR-127F Extension of Time to File a

Clear

Fiduciary Income Tax Return

Government of the

District of Columbia

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

Estate or trust’s federal employer ID number

Estate or trust’s social security number

Tax period ending (MMYY)

OFFICIAL USE ONLY

Vendor ID#0002

Estate or trust name

Fiduciary’s name and title

Fiduciary’s address (number, street and apartment/suite #, if applicable)

City

State

Zip Code + 4

$

.00

Amount submitted with this request

l

2011 FR-127F P1

Revised 09/11

Extension of Time to File Fiduciary Income Tax Return

l

Print

*111270310002*

2011

FR-127F Extension of Time to File a

Clear

Fiduciary Income Tax Return

Government of the

District of Columbia

This is a FILL-IN format. Please do not handwrite

any data on this form other than your signature.

Estate or trust’s federal employer ID number

Estate or trust’s social security number

Tax period ending (MMYY)

OFFICIAL USE ONLY

Vendor ID#0002

Estate or trust name

Fiduciary’s name and title

Fiduciary’s address (number, street and apartment/suite #, if applicable)

City

State

Zip Code + 4

$

.00

Amount submitted with this request

l

l

2011 FR-127F P1

Revised 09/11

Extension of Time to File Fiduciary Income Tax Return

1

1 2

2