Form 60-047 - Application For Release Of Inheritance/estate Tax Liens

ADVERTISEMENT

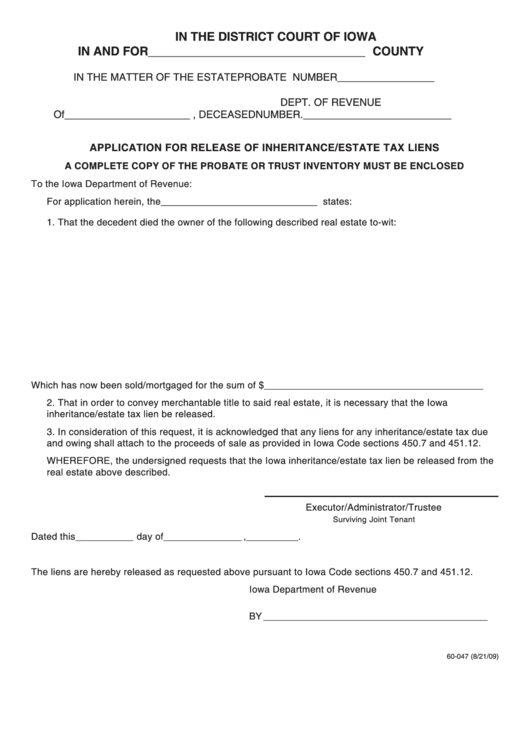

IN THE DISTRICT COURT OF IOWA

IN AND FOR ________________________________ COUNTY

IN THE MATTER OF THE ESTATE

PROBATE NUMBER _________________

DEPT. OF REVENUE

Of ______________________ , DECEASED

NUMBER. __________________________

APPLICATION FOR RELEASE OF INHERITANCE/ESTATE TAX LIENS

A COMPLETE COPY OF THE PROBATE OR TRUST INVENTORY MUST BE ENCLOSED

To the Iowa Department of Revenue:

For application herein, the ______________________________ states:

1. That the decedent died the owner of the following described real estate to-wit:

Which has now been sold/mortgaged for the sum of $ __________________________________________

2. That in order to convey merchantable title to said real estate, it is necessary that the Iowa

inheritance/estate tax lien be released.

3. In consideration of this request, it is acknowledged that any liens for any inheritance/estate tax due

and owing shall attach to the proceeds of sale as provided in Iowa Code sections 450.7 and 451.12.

WHEREFORE, the undersigned requests that the Iowa inheritance/estate tax lien be released from the

real estate above described.

Executor/Administrator/Trustee

Surviving Joint Tenant

Dated this ___________ day of _______________ , __________ .

The liens are hereby released as requested above pursuant to Iowa Code sections 450.7 and 451.12.

Iowa Department of Revenue

BY ___________________________________________

60-047 (8/21/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1