Form 78-914 - Iowa Tax Rate Schedule - 2012

ADVERTISEMENT

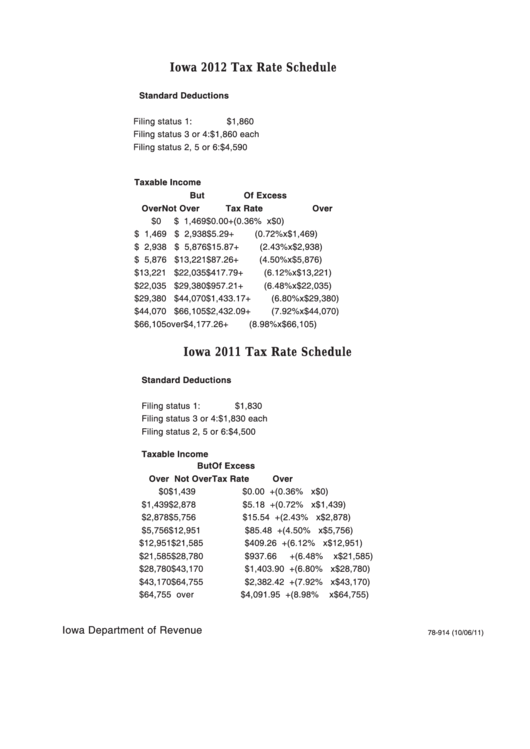

Iowa 2012 Tax Rate Schedule

Standard Deductions

Filing status 1:

$1,860

Filing status 3 or 4:

$1,860 each

Filing status 2, 5 or 6: $4,590

Taxable Income

But

Of Excess

Over Not Over

Tax Rate

Over

$0

$ 1,469

$0.00

+

(0.36% x

$0)

$ 1,469 $ 2,938

$5.29

+

(0.72% x

$1,469)

$ 2,938 $ 5,876

$15.87

+

(2.43% x

$2,938)

$ 5,876 $13,221

$87.26

+

(4.50% x

$5,876)

$13,221 $22,035

$417.79

+

(6.12% x

$13,221)

$22,035 $29,380

$957.21

+

(6.48% x

$22,035)

$29,380 $44,070

$1,433.17 +

(6.80% x

$29,380)

$44,070 $66,105

$2,432.09 +

(7.92% x

$44,070)

$66,105

over

$4,177.26 +

(8.98% x

$66,105)

Iowa 2011 Tax Rate Schedule

Standard Deductions

Filing status 1:

$1,830

Filing status 3 or 4:

$1,830 each

Filing status 2, 5 or 6: $4,500

Taxable Income

But

Of Excess

Over Not Over

Tax Rate

Over

$0

$1,439

$0.00

+

(0.36%

x

$0)

$1,439

$2,878

$5.18

+

(0.72%

x

$1,439)

$2,878

$5,756

$15.54

+

(2.43%

x

$2,878)

$5,756

$12,951

$85.48

+

(4.50%

x

$5,756)

$12,951

$21,585

$409.26

+

(6.12%

x

$12,951)

$21,585

$28,780

$937.66

+

(6.48%

x

$21,585)

$28,780

$43,170

$1,403.90 +

(6.80%

x

$28,780)

$43,170

$64,755

$2,382.42 +

(7.92%

x

$43,170)

$64,755

over

$4,091.95 +

(8.98%

x

$64,755)

Iowa Department of Revenue

78-914 (10/06/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1