Form 60-027 - Iowa Inheritance/estate Tax - Application For Extension Of Time To File

ADVERTISEMENT

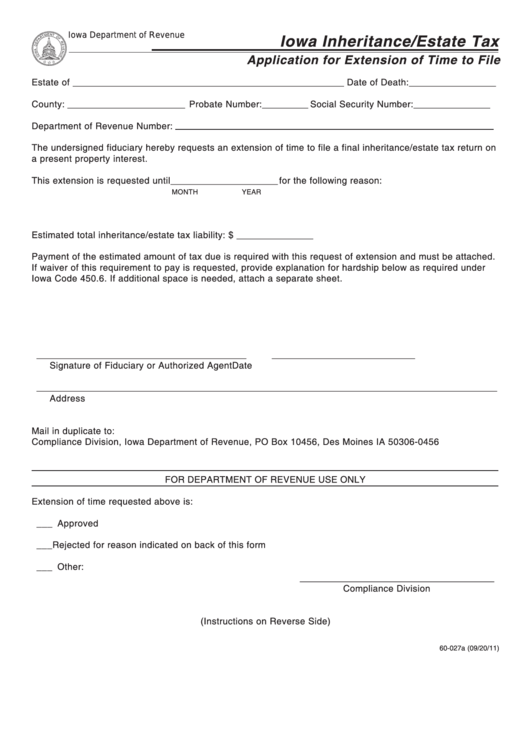

Iowa Department of Revenue

Iowa Inheritance/Estate Tax

Application for Extension of Time to File

Estate of _____________________________________________________ Date of Death: _________________

County: _______________________ Probate Number: _________ Social Security Number: _______________

Department of Revenue Number:

The undersigned fiduciary hereby requests an extension of time to file a final inheritance/estate tax return on

a present property interest.

This extension is requested until _____________________ for the following reason:

MONTH

YEAR

Estimated total inheritance/estate tax liability: $ _______________

Payment of the estimated amount of tax due is required with this request of extension and must be attached.

If waiver of this requirement to pay is requested, provide explanation for hardship below as required under

Iowa Code 450.6. If additional space is needed, attach a separate sheet.

_________________________________________

____________________________

Signature of Fiduciary or Authorized Agent

Date

__________________________________________________________________________________________

Address

Mail in duplicate to:

Compliance Division, Iowa Department of Revenue, PO Box 10456, Des Moines IA 50306-0456

FOR DEPARTMENT OF REVENUE USE ONLY

Extension of time requested above is:

___ Approved

___ Rejected for reason indicated on back of this form

___ Other:

______________________________________

Compliance Division

(Instructions on Reverse Side)

60-027a (09/20/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2