Form Nc-478l - Tax Credit Investing In Real Property - 2011

ADVERTISEMENT

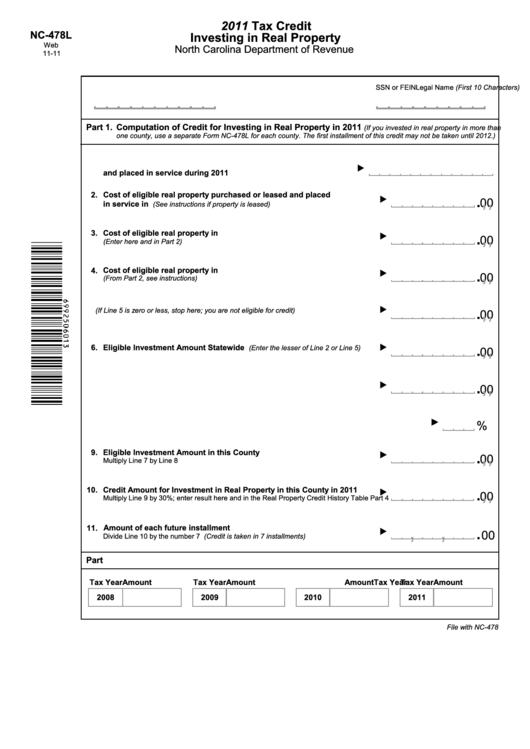

2011 Tax Credit

NC-478L

Investing in Real Property

Web

North Carolina Department of Revenue

11-11

Legal Name (First 10 Characters)

SSN or FEIN

Part 1.

Computation of Credit for Investing in Real Property in 2011

(If you invested in real property in more than

one county, use a separate Form NC-478L for each county. The first installment of this credit may not be taken until 2012.)

1. Tier 1 county where eligible real property was purchased or leased

and placed in service during 2011

,

,

.

Cost of eligible real property purchased or leased and placed

2.

00

in service in N.C. during 2011

(See instructions if property is leased)

,

,

.

3. Cost of eligible real property in N.C. on the last day of 2011

00

(Enter here and in Part 2)

,

,

.

4. Cost of eligible real property in N.C. on the last day of the base year

00

(From Part 2, see instructions)

,

,

.

5. Line 3 minus Line 4

(If Line 5 is zero or less, stop here; you are not eligible for credit)

00

,

,

.

6. Eligible Investment Amount Statewide

(Enter the lesser of Line 2 or Line 5)

00

,

,

.

7. Amount of Line 6 located in this county

00

8. Percentage of real property used in eligible business in 2011

%

,

,

.

9. Eligible Investment Amount in this County

00

Multiply Line 7 by Line 8

,

,

.

10. Credit Amount for Investment in Real Property in this County in 2011

00

Multiply Line 9 by 30%; enter result here and in the Real Property Credit History Table Part 4

,

,

.

11. Amount of each future installment

00

Divide Line 10 by the number 7 (Credit is taken in 7 installments)

Part 2. Real Property in Service in N.C. on Last Day of Tax Year

Tax Year

Amount

Tax Year

Amount

Tax Year

Amount

Tax Year

Amount

2008

2009

2010

2011

File with NC-478

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2