Form Tc-40abc - Credit For Tax Paid To Another State - State Of Utah - 2003

ADVERTISEMENT

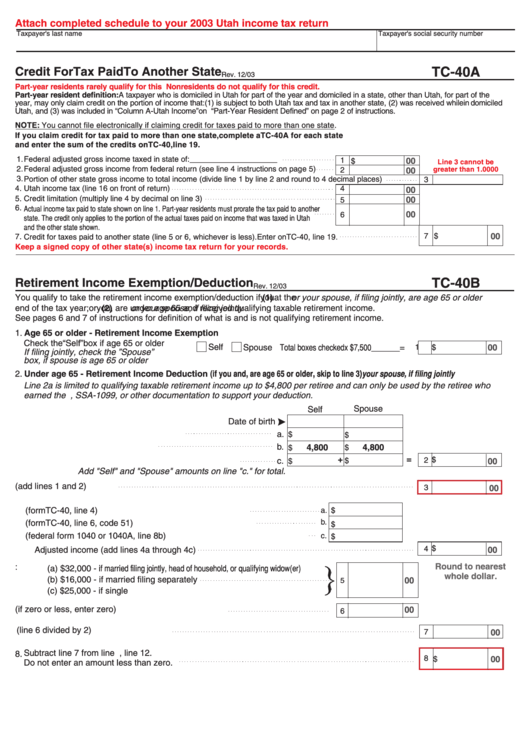

Attach completed schedule to your 2003 Utah income tax return

Taxpayer's last name

Taxpayer's social security number

Credit For Tax Paid To Another State

TC-40A

Rev. 12/03

Part-year residents rarely qualify for this credit.

Nonresidents do not qualify for this credit.

See instructions on page 10.

Part-year resident definition: A taxpayer who is domiciled in Utah for part of the year and domiciled in a state, other than Utah, for part of the

year, may only claim credit on the portion of income that: (1) is subject to both Utah tax and tax in another state, (2) was received while

domiciled

in

Utah, and (3) was included in “Column A-Utah Income” on TC-40C. Also see “Part-Year Resident Defined” on page 2 of instructions.

NOTE: You cannot file electronically if claiming credit for taxes paid to more than one state.

If you claim credit for tax paid to more than one state, complete a TC-40A for each state

and enter the sum of the credits on TC-40, line 19.

1.

Federal adjusted gross income taxed in state of: ____________________

1

00

$

Line 3 cannot be

2.

Federal adjusted gross income from federal return (see line 4 instructions on page 5)

greater than 1.0000

2

00

3.

Portion of other state gross income to total income (divide line 1 by line 2 and round to 4 decimal places)

3

4.

Utah income tax (line 16 on front of return)

4

00

5.

Credit limitation (multiply line 4 by decimal on line 3)

00

5

6.

Actual income tax paid to state shown on line 1. Part-year residents must prorate the tax paid to another

00

6

state. The credit only applies to the portion of the actual taxes paid on income that was taxed in Utah

and the other state shown.

7 $

00

7.

Credit for taxes paid to another state (line 5 or 6, whichever is less). Enter on TC-40, line 19.

Keep a signed copy of other state(s) income tax return for your records.

TC-40B

Retirement Income Exemption/Deduction

Rev. 12/03

You qualify to take the retirement income exemption/deduction if

(1)

you

or your spouse, if filing jointly, are age 65 or older

at the

or your spouse, if filing jointly

end of the tax year; or

(2)

you

, are under age 65 and received qualifying taxable retirement income.

See pages 6 and 7 of instructions for definition of what is and is not qualifying retirement income.

1. Age 65 or older - Retirement Income Exemption

Check the “Self” box if age 65 or older

Self

Total boxes checked

x $7,500

1

00

Spouse

______

=

$

If filing jointly, check the ”Spouse”

box, if spouse is age 65 or older

2. Under age 65 - Retirement Income Deduction (if you and

your spouse, if filing jointly

, are age 65 or older, skip to line 3)

Line 2a is limited to qualifying taxable retirement income up to $4,800 per retiree and can only be used by the retiree who

earned the income. ATTACH ALL FORMS 1099R, SSA-1099, or other documentation to support your deduction.

Spouse

Self

Date of birth

a. Qualified retirement income

a.

$

$

b. Retirement limitation

b.

4,800

4,800

$

$

+

=

$

c.

2

c. Enter the lesser of a or b for each column.

$

$

00

Add "Self" and "Spouse" amounts on line "c." for total.

3. Total (add lines 1 and 2)

3

00

4. Adjusted income

a. Enter federal adjusted gross income (form TC-40, line 4)

a.

$

b.

b. Enter any lump-sum amount (form TC-40, line 6, code 51)

$

c. Enter non-taxable interest amount (federal form 1040 or 1040A, line 8b)

c.

$

$

4

Adjusted income (add lines 4a through 4c)

00

Round to nearest

5.Enter:

(a) $32,000 - if married filing jointly, head of household, or qualifying widow(er)

whole dollar.

(b) $16,000 - if married filing separately

00

5

(c) $25,000 - if single

6. Subtract line 5 from line 4 (if zero or less, enter zero)

00

6

7. One-half of line 6 (line 6 divided by 2)

7

00

Subtract line 7 from line 3. This is your retirement exemption/deduction. Enter on TC-40, line 12.

8.

8

$

00

Do not enter an amount less than zero.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2