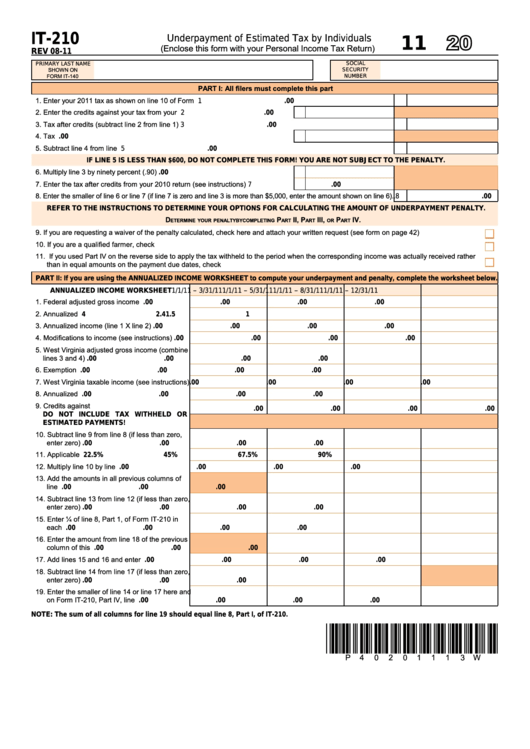

Form It-210 - Underpayment Of Estimated Tax By Individuals - 2011

ADVERTISEMENT

2011

IT-210

Underpayment of Estimated Tax by Individuals

(Enclose this form with your Personal Income Tax Return)

REV 08-11

SOCIAL

PRIMARY LAST NAME

SHOWN ON

SECURITY

FORM IT-140

NUMBER

PART I: All filers must complete this part

1. Enter your 2011 tax as shown on line 10 of Form IT-140................................................................................................

1

.00

2. Enter the credits against your tax from your return.................................................. 2

.00

3. Tax after credits (subtract line 2 from line 1)..............................................................................................................

3

.00

4. Tax withheld.............................................................................................................. 4

.00

5. Subtract line 4 from line 3..........................................................................................................................................

5

.00

IF LINE 5 IS LESS ThAN $600, DO NOT COMPLETE ThIS FORM! YOU ARE NOT SUBJECT TO ThE PENALTY.

6. Multiply line 3 by ninety percent (.90)......................................................................

6

.00

7. Enter the tax after credits from your 2010 return (see instructions).......................... 7

.00

8. Enter the smaller of line 6 or line 7 (if line 7 is zero and line 3 is more than $5,000, enter the amount shown on line 6)..

8

.00

REFER TO ThE INSTRUCTIONS TO DETERMINE YOUR OPTIONS FOR CALCULATING ThE AMOUNT OF UNDERPAYMENT PENALTY.

D

P

II, P

III,

P

IV.

eterMIne yoUr Penalty by CoMPletIng

art

art

or

art

9. If you are requesting a waiver of the penalty calculated, check here and attach your written request (see form on page 42)..................................

10. If you are a qualified farmer, check here.................................................................................................................................................................

11. If you used Part IV on the reverse side to apply the tax withheld to the period when the corresponding income was actually received rather

than in equal amounts on the payment due dates, check here..............................................................................................................................

PART II: If you are using the ANNUALIZED INCOME WORKShEET to compute your underpayment and penalty, complete the worksheet below.

ANNUALIZED INCOME WORKShEET

1/1/11 – 3/31/11

1/1/11 – 5/31/11

1/1/11 – 8/31/11

1/1/11 – 12/31/11

1. Federal adjusted gross income year-to-date.....

.00

.00

.00

.00

2. Annualized amounts..........................................

4

2.4

1.5

1

3. Annualized income (line 1 X line 2)...................

.00

.00

.00

.00

4. Modifications to income (see instructions)........

.00

.00

.00

.00

5. West Virginia adjusted gross income (combine

lines 3 and 4).....................................................

.00

.00

.00

.00

6. Exemption allowance.........................................

.00

.00

.00

.00

7. West Virginia taxable income (see instructions)

.00

.00

.00

.00

8. Annualized tax...................................................

.00

.00

.00

.00

9. Credits against tax.............................................

.00

.00

.00

.00

DO NOT INCLUDE TAx WIThhELD OR

ESTIMATED PAYMENTS!

10. Subtract line 9 from line 8 (if less than zero,

enter zero).......................................................

.00

.00

.00

.00

11. Applicable percentage......................................

22.5%

45%

67.5%

90%

12. Multiply line 10 by line 11................................

.00

.00

.00

.00

13. Add the amounts in all previous columns of

line 19..............................................................

.00

.00

.00

14. Subtract line 13 from line 12 (if less than zero,

enter zero).......................................................

.00

.00

.00

.00

15. Enter ¼ of line 8, Part 1, of Form IT-210 in

each column....................................................

.00

.00

.00

.00

16. Enter the amount from line 18 of the previous

column of this worksheet.................................

.00

.00

.00

17. Add lines 15 and 16 and enter total...................

.00

.00

.00

.00

18. Subtract line 14 from line 17 (if less than zero,

enter zero)..............................................

.00

.00

.00

19. Enter the smaller of line 14 or line 17 here and

on Form IT-210, Part IV, line 1..................

.00

.00

.00

.00

NOTE: The sum of all columns for line 19 should equal line 8, Part I, of IT-210.

*p40201113W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2