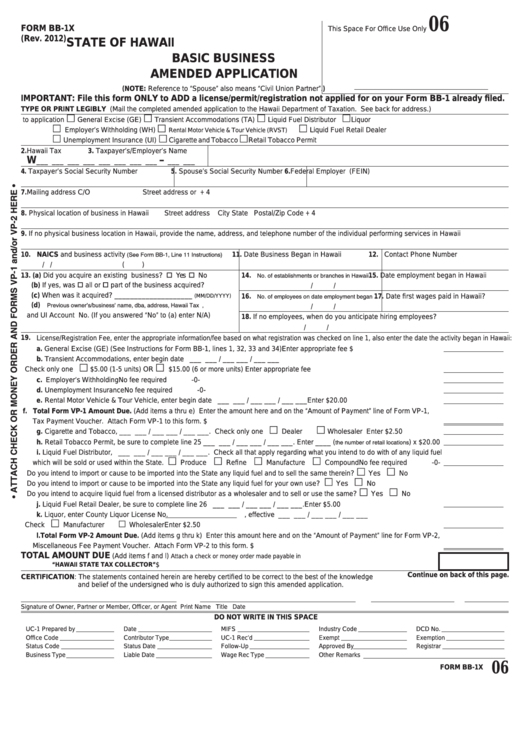

06

FORM BB-1X

This Space For Office Use Only

(Rev. 2012)

STATE OF HAWAII

BASIC BUSINESS

AMENDED APPLICATION

U.I. No.

(NOTE: Reference to “Spouse” also means “Civil Union Partner”.)

IMPORTANT: File this form ONLY to ADD a license/permit/registration not applied for on your Form BB-1 already filed.

TYPE OR PRINT LEGIBLY

(Mail the completed amended application to the Hawaii Department of Taxation. See back for address.)

1.

ADD to application

General Excise (GE)

Transient Accommodations (TA)

Liquid Fuel Distributor

Liquor

Employer’s Withholding (WH)

Liquid Fuel Retail Dealer

Rental Motor Vehicle & Tour Vehicle (RVST)

Unemployment Insurance (UI)

Cigarette and Tobacco

Retail Tobacco Permit

2.

Hawaii Tax I.D. No.

3. Taxpayer’s/Employer’s Name

W

–

___ ___ ___ ___ ___ ___ ___ ___

___ ___

4.

Taxpayer’s Social Security Number

5. Spouse’s Social Security Number

6. Federal Employer I.D. Number (FEIN)

7.

Mailing address

C/O

Street address or P.O. Box

City

State Postal/Zip Code + 4

8.

Physical location of business in Hawaii

Street address

City

State Postal/Zip Code + 4

9.

If no physical business location in Hawaii, provide the name, address, and telephone number of the individual performing services in Hawaii

10. NAICS and business activity (See Form BB-1, Line 11 Instructions)

11. Date Business Began in Hawaii

12. Contact Phone Number

/

/

(

)

14. No. of establishments or branches in Hawaii

13. (a) Did you acquire an existing business? Yes No

15. Date employment began in Hawaii

(b) If yes, was all or part of the business acquired?

/

/

16. No. of employees on date employment began

(c) When was it acquired? ____________________

17. Date first wages paid in Hawaii?

(MM/DD/YYYY)

(d) Previous owner’s/business’ name, dba, address, Hawaii Tax I.D. No.,

/

/

and UI Account No. (If you answered “No” to (a) enter N/A)

18. If no employees, when do you anticipate hiring employees?

/

/

19. License/Registration Fee, enter the appropriate information/fee based on what registration was checked on line 1, also enter the date the activity began in Hawaii:

a. General Excise (GE) (See Instructions for Form BB-1, lines 1, 32, 33 and 34) ...............................................Enter appropriate fee

$

b. Transient Accommodations, enter begin date ___ ___ / ___ ___ / ___ ___

Check only one

$5.00 (1-5 units) OR

$15.00 (6 or more units) ..............................................Enter appropriate fee

c. Employer’s Withholding .............................................................................................................................................No fee required

-0-

d. Unemployment Insurance .........................................................................................................................................No fee required

-0-

e. Rental Motor Vehicle & Tour Vehicle, enter begin date ___ ___ / ___ ___ / ___ ___ ................................................Enter $20.00

f. Total Form VP-1 Amount Due. (Add items a thru e) Enter the amount here and on the “Amount of Payment” line of Form VP-1,

Tax Payment Voucher. Attach Form VP-1 to this form. .....................................................................................................................

$

g. Cigarette and Tobacco, ___ ___ / ___ ___ / ___ ___. Check only one

Dealer

Wholesaler ..................Enter $2.50

h. Retail Tobacco Permit, be sure to complete line 25 ___ ___ / ___ ___ / ___ ___. Enter ____ (the number of retail locations) x $20.00

i. Liquid Fuel Distributor, ___ ___ / ___ ___ / ___ ___. Check all that apply regarding what you intend to do with of any liquid fuel

which will be sold or used within the State.

Produce

Refine

Manufacture

Compound .......No fee required

-0-

Do you intend to import or cause to be imported into the State any liquid fuel and to sell the same therein?

Yes

No

Do you intend to import or cause to be imported into the State any liquid fuel for your own use?

Yes

No

Do you intend to acquire liquid fuel from a licensed distributor as a wholesaler and to sell or use the same?

Yes

No

j. Liquid Fuel Retail Dealer, be sure to complete line 26

___ ___ / ___ ___ / ___ ___. ................................................Enter $5.00

k. Liquor, enter County Liquor License No.

, effective ___ ___ / ___ ___ / ___ ___

Check

Manufacturer

Wholesaler ..................................................................................................Enter $2.50

l. Total Form VP-2 Amount Due. (Add items g thru k) Enter this amount here and on the “Amount of Payment” line for Form VP-2,

Miscellaneous Fee Payment Voucher. Attach Form VP-2 to this form. ............................................................................................

$

TOTAL AMOUNT DUE

(Add items f and l)

Attach a check or money order made payable in U.S. dollars drawn on any

$

U.S. Bank to “HAWAII STATE TAX COLLECTOR” ..............................................................................................................

Continue on back of this page.

CERTIFICATION: The statements contained herein are hereby certified to be correct to the best of the knowledge

and belief of the undersigned who is duly authorized to sign this amended application.

Signature of Owner, Partner or Member, Officer, or Agent

Print Name

Title

Date

DO NOT WRITE IN THIS SPACE

UC-1 Prepared by

Date

MIFS

Industry Code

DCD No.

Office Code

Contributor Type

UC-1 Rec’d

Exempt

Exemption

Status Code

Status Date

Follow-Up

Approved By

Registrar

Business Type

Liable Date

Wage Rec Type

Other Remarks

06

FORM BB-1X

1

1 2

2