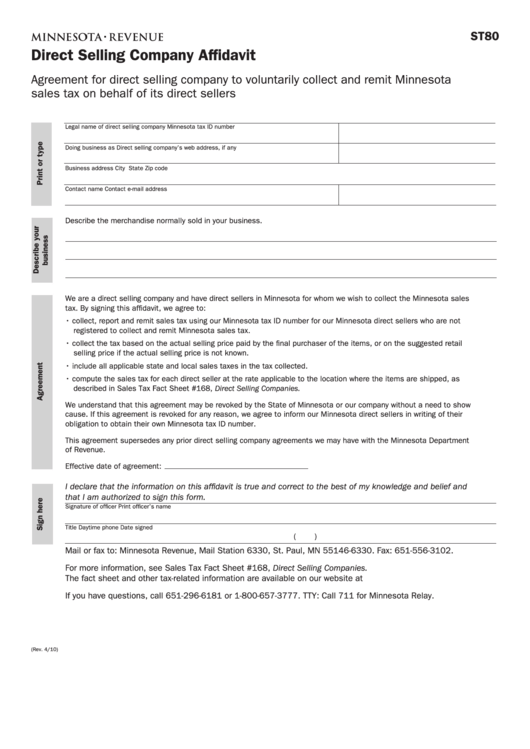

ST80

Direct Selling Company Affidavit

Agreement for direct selling company to voluntarily collect and remit Minnesota

sales tax on behalf of its direct sellers

Legal name of direct selling company

Minnesota tax ID number

Doing business as

Direct selling company’s web address, if any

Business address

City

State

Zip code

Contact name

Contact e-mail address

Describe the merchandise normally sold in your business.

We are a direct selling company and have direct sellers in Minnesota for whom we wish to collect the Minnesota sales

tax. By signing this affidavit, we agree to:

• collect, report and remit sales tax using our Minnesota tax ID number for our Minnesota direct sellers who are not

registered to collect and remit Minnesota sales tax.

• collect the tax based on the actual selling price paid by the final purchaser of the items, or on the suggested retail

selling price if the actual selling price is not known.

• include all applicable state and local sales taxes in the tax collected.

• compute the sales tax for each direct seller at the rate applicable to the location where the items are shipped, as

described in Sales Tax Fact Sheet #168, Direct Selling Companies.

We understand that this agreement may be revoked by the State of Minnesota or our company without a need to show

cause. If this agreement is revoked for any reason, we agree to inform our Minnesota direct sellers in writing of their

obligation to obtain their own Minnesota tax ID number.

This agreement supersedes any prior direct selling company agreements we may have with the Minnesota Department

of Revenue.

Effective date of agreement:

I declare that the information on this affidavit is true and correct to the best of my knowledge and belief and

that I am authorized to sign this form.

Signature of officer

Print officer’s name

Title

Daytime phone

Date signed

(

)

Mail or fax to: Minnesota Revenue, Mail Station 6330, St. Paul, MN 55146-6330. Fax: 651-556-3102.

For more information, see Sales Tax Fact Sheet #168, Direct Selling Companies.

The fact sheet and other tax-related information are available on our website at

If you have questions, call 651-296-6181 or 1-800-657-3777. TTY: Call 711 for Minnesota Relay.

(Rev. 4/10)

1

1