Form Mvr-103/mvr-103cs - Instructions For The Motor Vehicle Rental & County Supplemental Motor Vehicle Rental Excise Tax Template

ADVERTISEMENT

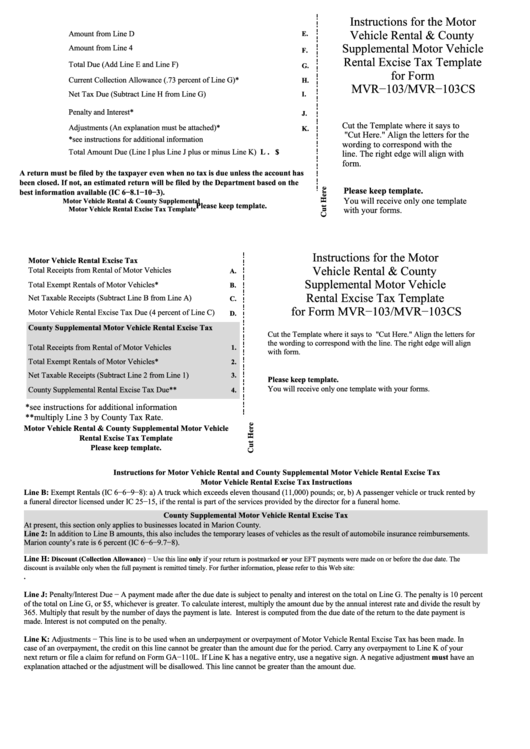

Instructions for the Motor

Vehicle Rental & County

Amount from Line D ................................................................................

E.

Supplemental Motor Vehicle

Amount from Line 4 .................................................................................

F.

Rental Excise Tax Template

Total Due (Add Line E and Line F) ..........................................................

G.

for Form

Current Collection Allowance (.73 percent of Line G)* .........................

H.

MVR−103/MVR−103CS

Net Tax Due (Subtract Line H from Line G) ............................................

I.

Penalty and Interest* ................................................................................

J.

Cut the Template where it says to

Adjustments (An explanation must be attached)* ...................................

K.

"Cut Here." Align the letters for the

*see instructions for additional information

wording to correspond with the

Total Amount Due (Line I plus Line J plus or minus Line K) ...... L . $

line. The right edge will align with

form.

A return must be filed by the taxpayer even when no tax is due unless the account has

been closed. If not, an estimated return will be filed by the Department based on the

Please keep template.

best information available (IC 6−8.1−10−3).

You will receive only one template

Motor Vehicle Rental & County Supplemental

Please keep template.

Motor Vehicle Rental Excise Tax Template

with your forms.

Instructions for the Motor

Motor Vehicle Rental Excise Tax

Vehicle Rental & County

Total Receipts from Rental of Motor Vehicles ..........................

A.

Supplemental Motor Vehicle

Total Exempt Rentals of Motor Vehicles* .................................

B.

Rental Excise Tax Template

Net Taxable Receipts (Subtract Line B from Line A) ................

C.

for Form MVR−103/MVR−103CS

Motor Vehicle Rental Excise Tax Due (4 percent of Line C).......

D.

County Supplemental Motor Vehicle Rental Excise Tax

Cut the Template where it says to "Cut Here." Align the letters for

the wording to correspond with the line. The right edge will align

Total Receipts from Rental of Motor Vehicles ...........................

1.

with form.

Total Exempt Rentals of Motor Vehicles* .................................

2.

Net Taxable Receipts (Subtract Line 2 from Line 1) ..................

3.

Please keep template.

You will receive only one template with your forms.

County Supplemental Rental Excise Tax Due** ........................

4.

*see instructions for additional information

**multiply Line 3 by County Tax Rate.

Motor Vehicle Rental & County Supplemental Motor Vehicle

Rental Excise Tax Template

Please keep template.

Instructions for Motor Vehicle Rental and County Supplemental Motor Vehicle Rental Excise Tax

Motor Vehicle Rental Excise Tax Instructions

Line B: Exempt Rentals (IC 6−6−9−8): a) A truck which exceeds eleven thousand (11,000) pounds; or, b) A passenger vehicle or truck rented by

a funeral director licensed under IC 25−15, if the rental is part of the services provided by the director for a funeral home.

County Supplemental Motor Vehicle Rental Excise Tax

At present, this section only applies to businesses located in Marion County.

Line 2: In addition to Line B amounts, this also includes the temporary leases of vehicles as the result of automobile insurance reimbursements.

Marion county’s rate is 6 percent (IC 6−6−9.7−8).

Line H:

Discount (Collection Allowance) − Use this line only if your return is postmarked or your EFT payments were made on or before the due date. The

discount is available only when the full payment is remitted timely. For further information, please refer to this Web site:

.

Line J: Penalty/Interest Due − A payment made after the due date is subject to penalty and interest on the total on Line G. The penalty is 10 percent

of the total on Line G, or $5, whichever is greater. To calculate interest, multiply the amount due by the annual interest rate and divide the result by

365. Multiply that result by the number of days the payment is late. Interest is computed from the due date of the return to the date payment is

made. Interest is not computed on the penalty.

Line K: Adjustments − This line is to be used when an underpayment or overpayment of Motor Vehicle Rental Excise Tax has been made. In

case of an overpayment, the credit on this line cannot be greater than the amount due for the period. Carry any overpayment to Line K of your

next return or file a claim for refund on Form GA−110L. If Line K has a negative entry, use a negative sign. A negative adjustment must have an

explanation attached or the adjustment will be disallowed. This line cannot be greater than the amount due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1