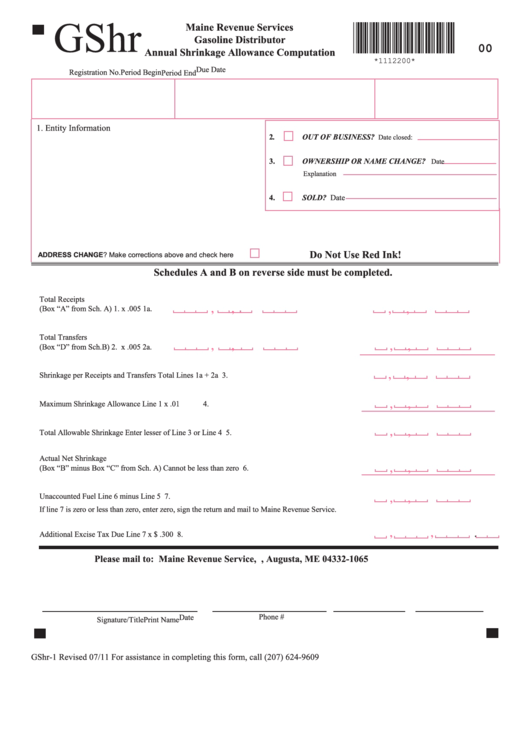

Form Gshr - Annual Shrinkage Allowance Computation

ADVERTISEMENT

GShr

Maine Revenue Services

Gasoline Distributor

00

Annual Shrinkage Allowance Computation

*1112200*

Due Date

Registration No.

Period Begin

Period End

1. Entity Information

2.

OUT OF BUSINESS?

Date closed:

3.

OWNERSHIP OR NAME CHANGE?

Date

Explanation

SOLD? Date

4.

Do Not Use Red Ink!

ADDRESS CHANGE? Make corrections above and check here

Schedules A and B on reverse side must be completed.

Total Receipts

,

,

,

,

(Box “A” from Sch. A)

1.

x .005 1a.

Total Transfers

,

,

,

,

(Box “D” from Sch.B)

2.

x .005 2a.

,

,

Shrinkage per Receipts and Transfers

Total Lines 1a + 2a

3.

,

,

Maximum Shrinkage Allowance

Line 1 x .01

4.

,

,

Total Allowable Shrinkage

Enter lesser of Line 3 or Line 4

5.

Actual Net Shrinkage

,

,

(Box “B” minus Box “C” from Sch. A)

Cannot be less than zero

6.

Unaccounted Fuel

Line 6 minus Line 5

7.

,

,

If line 7 is zero or less than zero, enter zero, sign the return and mail to Maine Revenue Service.

,

,

.

Additional Excise Tax Due

Line 7 x $ .300

8.

Please mail to: Maine Revenue Service, P.O. Box 1065, Augusta, ME 04332-1065

Phone #

Date

Signature/Title

Print Name

GShr-1 Revised 07/11

For assistance in completing this form, call (207) 624-9609

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2