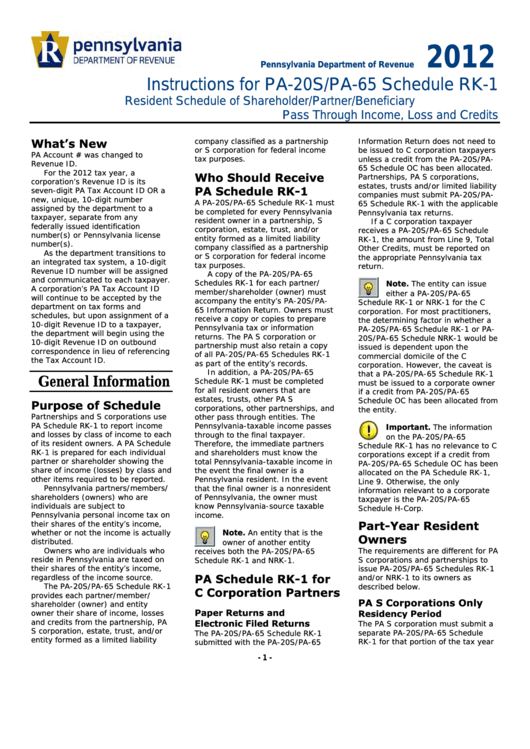

Instructions For Form Pa-20s/pa-65 - Schedule Rk-1 - Resident Schedule Of Shareholder/partner/beneficiary Pass Through Income, Loss And Credits - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule RK-1

Resident Schedule of Shareholder/Partner/Beneficiary

Pass Through Income, Loss and Credits

What’s New

company classified as a partnership

Information Return does not need to

or S corporation for federal income

be issued to C corporation taxpayers

PA Account # was changed to

tax purposes.

unless a credit from the PA-20S/PA-

Revenue ID.

65 Schedule OC has been allocated.

For the 2012 tax year, a

Who Should Receive

Partnerships, PA S corporations,

corporation’s Revenue ID is its

estates, trusts and/or limited liability

PA Schedule RK-1

seven-digit PA Tax Account ID OR a

companies must submit PA-20S/PA-

new, unique, 10-digit number

A PA-20S/PA-65 Schedule RK-1 must

65 Schedule RK-1 with the applicable

assigned by the department to a

be completed for every Pennsylvania

Pennsylvania tax returns.

taxpayer, separate from any

resident owner in a partnership, S

If a C corporation taxpayer

federally issued identification

corporation, estate, trust, and/or

receives a PA-20S/PA-65 Schedule

number(s) or Pennsylvania license

entity formed as a limited liability

RK-1, the amount from Line 9, Total

number(s).

company classified as a partnership

Other Credits, must be reported on

As the department transitions to

or S corporation for federal income

the appropriate Pennsylvania tax

an integrated tax system, a 10-digit

tax purposes.

return.

Revenue ID number will be assigned

A copy of the PA-20S/PA-65

and communicated to each taxpayer.

Note.

Schedules RK-1 for each partner/

The entity can issue

A corporation’s PA Tax Account ID

member/shareholder (owner) must

either a PA-20S/PA-65

will continue to be accepted by the

accompany the entity’s PA-20S/PA-

Schedule RK-1 or NRK-1 for the C

department on tax forms and

65 Information Return. Owners must

corporation. For most practitioners,

schedules, but upon assignment of a

receive a copy or copies to prepare

the determining factor in whether a

10-digit Revenue ID to a taxpayer,

Pennsylvania tax or information

PA-20S/PA-65 Schedule RK-1 or PA-

the department will begin using the

returns. The PA S corporation or

20S/PA-65 Schedule NRK-1 would be

10-digit Revenue ID on outbound

partnership must also retain a copy

issued is dependent upon the

correspondence in lieu of referencing

of all PA-20S/PA-65 Schedules RK-1

commercial domicile of the C

the Tax Account ID.

as part of the entity’s records.

corporation. However, the caveat is

In addition, a PA-20S/PA-65

that a PA-20S/PA-65 Schedule RK-1

General Information

Schedule RK-1 must be completed

must be issued to a corporate owner

for all resident owners that are

if a credit from PA-20S/PA-65

estates, trusts, other PA S

Schedule OC has been allocated from

Purpose of Schedule

corporations, other partnerships, and

the entity.

Partnerships and S corporations use

other pass through entities. The

PA Schedule RK-1 to report income

Pennsylvania-taxable income passes

Important.

The information

and losses by class of income to each

through to the final taxpayer.

on the PA-20S/PA-65

of its resident owners. A PA Schedule

Therefore, the immediate partners

Schedule RK-1 has no relevance to C

RK-1 is prepared for each individual

and shareholders must know the

corporations except if a credit from

partner or shareholder showing the

total Pennsylvania-taxable income in

PA-20S/PA-65 Schedule OC has been

share of income (losses) by class and

the event the final owner is a

allocated on the PA Schedule RK-1,

other items required to be reported.

Pennsylvania resident. In the event

Line 9. Otherwise, the only

Pennsylvania partners/members/

that the final owner is a nonresident

information relevant to a corporate

shareholders (owners) who are

of Pennsylvania, the owner must

taxpayer is the PA-20S/PA-65

individuals are subject to

know Pennsylvania-source taxable

Schedule H-Corp.

Pennsylvania personal income tax on

income.

their shares of the entity’s income,

Part-Year Resident

Note.

whether or not the income is actually

An entity that is the

Owners

distributed.

owner of another entity

Owners who are individuals who

The requirements are different for PA

receives both the PA-20S/PA-65

reside in Pennsylvania are taxed on

S corporations and partnerships to

Schedule RK-1 and NRK-1.

their shares of the entity’s income,

issue PA-20S/PA-65 Schedules RK-1

PA Schedule RK-1 for

regardless of the income source.

and/or NRK-1 to its owners as

The PA-20S/PA-65 Schedule RK-1

described below.

C Corporation Partners

provides each partner/member/

PA S Corporations Only

shareholder (owner) and entity

Paper Returns and

owner their share of income, losses

Residency Period

and credits from the partnership, PA

Electronic Filed Returns

The PA S corporation must submit a

S corporation, estate, trust, and/or

separate PA-20S/PA-65 Schedule

The PA-20S/PA-65 Schedule RK-1

entity formed as a limited liability

RK-1 for that portion of the tax year

submitted with the PA-20S/PA-65

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6