Save

Reset

Print

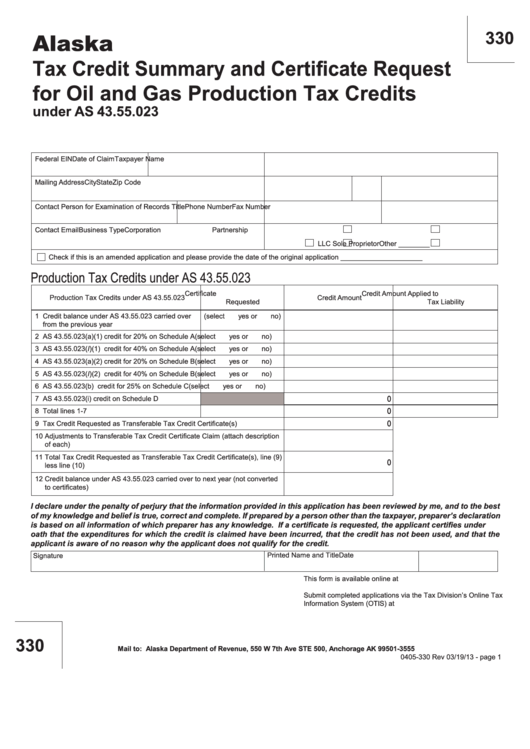

330

Alaska

Tax Credit Summary and Certificate Request

for Oil and Gas Production Tax Credits

under AS 43.55.023

Federal EIN

Date of Claim

Taxpayer Name

Mailing Address

City

State

Zip Code

Contact Person for Examination of Records

Title

Phone Number

Fax Number

Contact Email

Business Type

Corporation

Partnership

LLC

Sole Proprietor

Other ________

Check if this is an amended application and please provide the date of the original application _____________________

Production Tax Credits under AS 43.55.023

Certificate

Credit Amount Applied to

Production Tax Credits under AS 43.55.023

Credit Amount

Requested

Tax Liability

1 Credit balance under AS 43.55.023 carried over

(select

yes or

no)

from the previous year

2 AS 43.55.023(a)(1) credit for 20% on Schedule A

(select

yes or

no)

3 AS 43.55.023(I)(1) credit for 40% on Schedule A

(select

yes or

no)

4 AS 43.55.023(a)(2) credit for 20% on Schedule B

(select

yes or

no)

5 AS 43.55.023(I)(2) credit for 40% on Schedule B

(select

yes or

no)

6 AS 43.55.023(b) credit for 25% on Schedule C

(select

yes or

no)

7 AS 43.55.023(i) credit on Schedule D

0

8 Total lines 1-7

0

9 Tax Credit Requested as Transferable Tax Credit Certificate(s)

0

10 Adjustments to Transferable Tax Credit Certificate Claim (attach description

of each)

11 Total Tax Credit Requested as Tran ferable Tax Credit Certificate(s), line (9)

0

less line (10)

12 Credit balance under AS 43.55.023 carried over to next year (not converted

to certificates)

I declare under the penalty of perjury that the information provided in this application has been reviewed by me, and to the best

of my knowledge and belief is true, correct and complete. If prepared by a person other than the taxpayer, preparer’s declaration

is based on all information of which preparer has any knowledge. If a certificate is requested, the applicant certifies under

oath that the expenditures for which the credit is claimed have been incurred, that the credit has not been used, and that the

applicant is aware of no reason why the applicant does not qualify for the credit.

Printed Name and Title

Date

Signature

This form is available online at

Submit completed applications via the Tax Division’s Online Tax

Information System (OTIS) at

330

Mail to: Alaska Department of Revenue, 550 W 7th Ave STE 500, Anchorage AK 99501-3555

0405-330 Rev 03/19/13 - page 1

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11