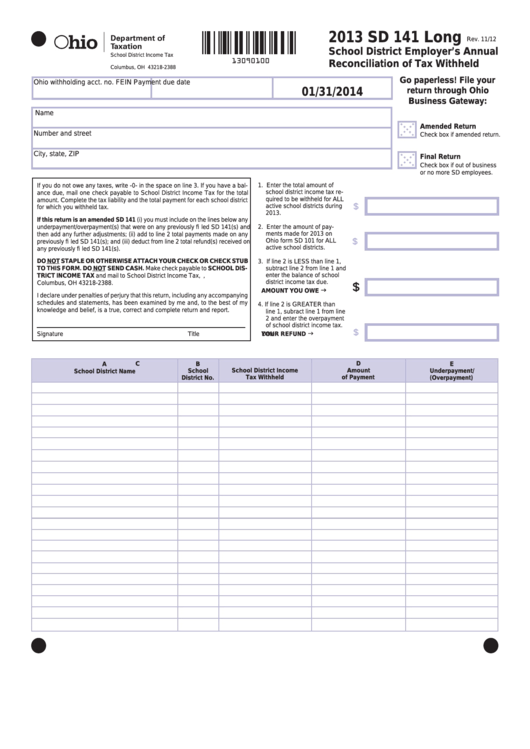

Reset Form

2013 SD 141 Long

Rev. 11/12

School District Employer’s Annual

School District Income Tax

13090100

P.O. Box 182388

Reconciliation of Tax Withheld

Columbus, OH 43218-2388

Go paperless! File your

Ohio withholding acct. no.

FEIN

Payment due date

01/31/2014

return through Ohio

Business Gateway:

tax.ohio.gov

Name

Amended Return

Number and street

Check box if amended return.

City, state, ZIP

Final Return

Check box if out of business

or no more SD employees.

If you do not owe any taxes, write -0- in the space on line 3. If you have a bal-

1. Enter the total amount of

school district income tax re-

ance due, mail one check payable to School District Income Tax for the total

quired to be withheld for ALL

amount. Complete the tax liability and the total payment for each school district

$

active school districts during

for which you withheld tax.

2013.

If this return is an amended SD 141 (i) you must include on the lines below any

2. Enter the amount of pay-

underpayment/overpayment(s) that were on any previously fi led SD 141(s) and

ments made for 2013 on

then add any further adjustments; (ii) add to line 2 total payments made on any

$

Ohio form SD 101 for ALL

previously fi led SD 141(s); and (iii) deduct from line 2 total refund(s) received on

active school districts.

any previously fi led SD 141(s).

DO NOT STAPLE OR OTHERWISE ATTACH YOUR CHECK OR CHECK STUB

3. If line 2 is LESS than line 1,

TO THIS FORM. DO NOT SEND CASH. Make check payable to SCHOOL DIS-

subtract line 2 from line 1 and

enter the balance of school

TRICT INCOME TAX and mail to School District Income Tax, P.O. Box 182388,

district income tax due.

Columbus, OH 43218-2388.

$

AMOUNT YOU OWE

I declare under penalties of perjury that this return, including any accompanying

schedules and statements, has been examined by me and, to the best of my

4. If line 2 is GREATER than

knowledge and belief, is a true, correct and complete return and report.

line 1, subract line 1 from line

2 and enter the overpayment

of school district income tax.

$

Signature

Title

Date

YOUR REFUND

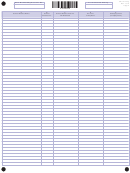

C

D

B

E

A

School District Income

Amount

School

Underpayment/

School District Name

Tax Withheld

of Payment

District No.

(Overpayment)

1

1 2

2