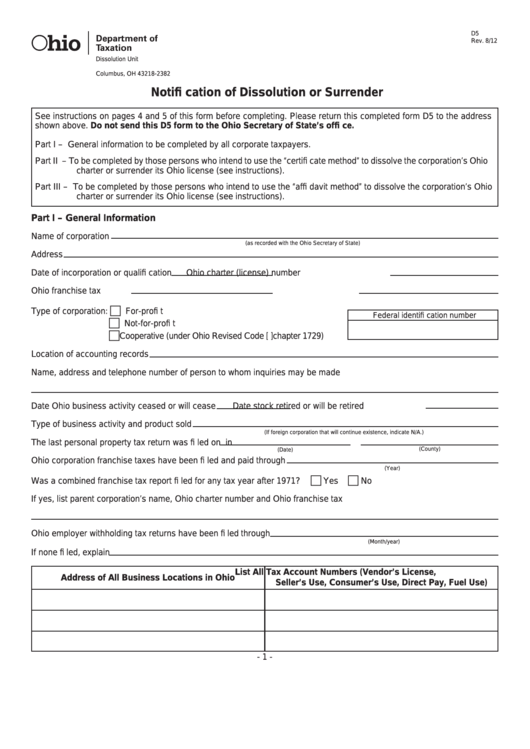

Reset Form

D5

Rev. 8/12

Dissolution Unit

P.O. Box 182382

Columbus, OH 43218-2382

Notifi cation of Dissolution or Surrender

See instructions on pages 4 and 5 of this form before completing. Please return this completed form D5 to the address

shown above. Do not send this D5 form to the Ohio Secretary of State’s offi ce.

Part I – General information to be completed by all corporate taxpayers.

Part II – To be completed by those persons who intend to use the “certifi cate method” to dissolve the corporation’s Ohio

charter or surrender its Ohio license (see instructions).

Part III – To be completed by those persons who intend to use the “affi davit method” to dissolve the corporation’s Ohio

charter or surrender its Ohio license (see instructions).

Part I – General Information

Name of corporation

(as recorded with the Ohio Secretary of State)

Address

Date of incorporation or qualifi cation

Ohio charter (license) number

Ohio franchise tax I.D. no.

State of incorporation

Type of corporation:

For-profi t

Federal identifi cation number

Not-for-profi t

Cooperative (under Ohio Revised Code [R.C.]chapter 1729)

Location of accounting records

Name, address and telephone number of person to whom inquiries may be made

Date Ohio business activity ceased or will cease

Date stock retired or will be retired

Type of business activity and product sold

(If foreign corporation that will continue existence, indicate N/A.)

The last personal property tax return was fi led on

in

(County)

(Date)

Ohio corporation franchise taxes have been fi led and paid through

(Year)

Was a combined franchise tax report fi led for any tax year after 1971?

Yes

No

If yes, list parent corporation’s name, Ohio charter number and Ohio franchise tax I.D. number

Ohio employer withholding tax returns have been fi led through

(Month/year)

If none fi led, explain

List All Tax Account Numbers (Vendor’s License,

Address of All Business Locations in Ohio

Seller’s Use, Consumer’s Use, Direct Pay, Fuel Use)

- 1 -

1

1 2

2 3

3 4

4 5

5