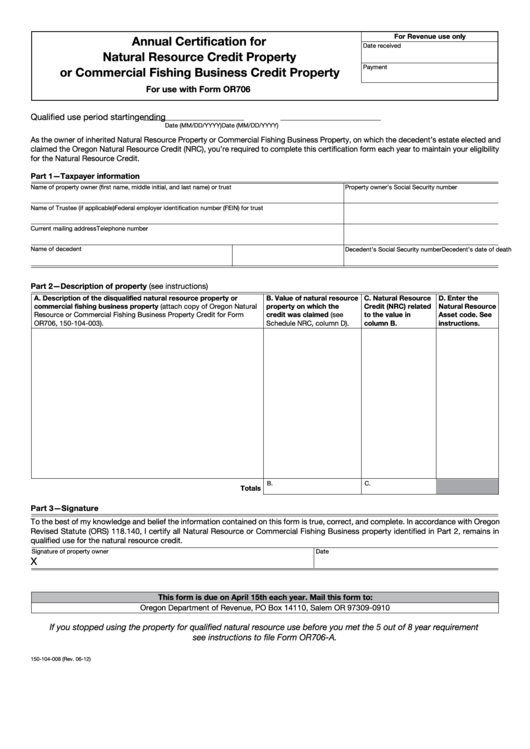

Clear Form

For Revenue use only

Annual Certification for

Date received

Natural Resource Credit Property

Payment

or Commercial Fishing Business Credit Property

For use with Form OR706

Qualified use period starting

ending

Date (MM/DD/YYYY)

Date (MM/DD/YYYY)

As the owner of inherited Natural Resource Property or Commercial Fishing Business Property, on which the decedent’s estate elected and

claimed the Oregon Natural Resource Credit (NRC), you’re required to complete this certification form each year to maintain your eligibility

for the Natural Resource Credit.

Part 1—Taxpayer information

Name of property owner (first name, middle initial, and last name) or trust

Property owner’s Social Security number

Name of Trustee (if applicable)

Federal employer identification number (FEIN) for trust

Current mailing address

Telephone number

Name of decedent

Decedent’s date of death

Decedent’s Social Security number

Part 2—Description of property (see instructions)

A. Description of the disqualified natural resource property or

B. Value of natural resource

C. Natural Resource

D. Enter the

commercial fishing business property (attach copy of Oregon Natural

property on which the

Credit (NRC) related

Natural Resource

Resource or Commercial Fishing Business Property Credit for Form

credit was claimed (see

to the value in

Asset code. See

OR706, 150-104-003).

Schedule NRC, column D).

column B.

instructions.

B.

C.

Totals

Part 3—Signature

To the best of my knowledge and belief the information contained on this form is true, correct, and complete. In accordance with Oregon

Revised Statute (ORS) 118.140, I certify all Natural Resource or Commercial Fishing Business property identified in Part 2, remains in

qualified use for the natural resource credit.

Signature of property owner

Date

X

This form is due on April 15th each year. Mail this form to:

Oregon Department of Revenue, PO Box 14110, Salem OR 97309-0910

If you stopped using the property for qualified natural resource use before you met the 5 out of 8 year requirement

see instructions to file Form OR706-A.

150-104-008 (Rev. 06-12)

1

1 2

2