Instructions For Completing The Wyoming Quarterly Ui/wc And Ui Only Summary Report Form

ADVERTISEMENT

Instructions

for completing the Wyoming Quarterly UI/WC and UI Only Summary Report form

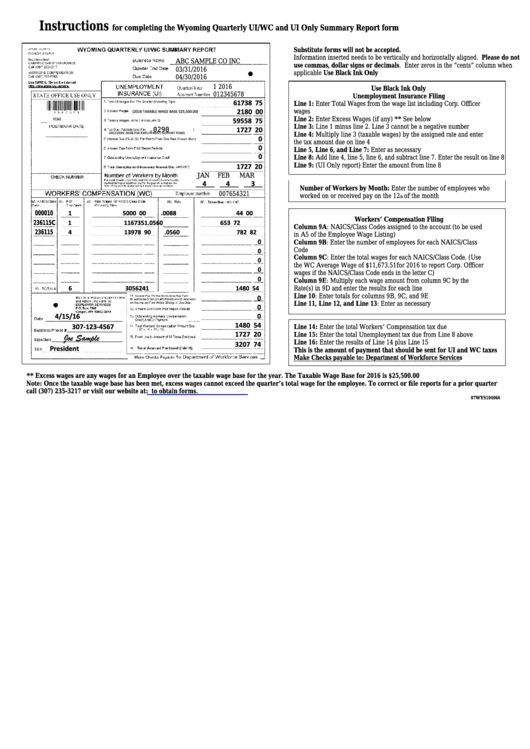

Substitute forms will not be accepted.

Information inserted needs to be vertically and horizontally aligned. Please do not

ABC SAMPLE CO INC

use commas, dollar signs or decimals. Enter zeros in the “cents” column when

03/31/2016

applicable Use Black Ink Only

04/30/2016

1 2016

Use Black Ink Only

012345678

Unemployment Insurance Filing

61738 75

Line 1: Enter Total Wages from the wage list including Corp. Officer

2180 00

(2016 TAXABLE WAGE BASE $25,500.00)

wages

59558 75

Line 2: Enter Excess Wages (if any) ** See below

Line 3: Line 1 minus line 2. Line 3 cannot be a negative number

1727 20

.0290

Line 4: Multiply line 3 (taxable wages) by the assigned rate and enter

0

(INCLUDES .00108 FOR EMPLOYMENT SUPPORT FUND)

the tax amount due on line 4

0

Line 5, Line 6, and Line 7: Enter as necessary

0

Line 8: Add line 4, line 5, line 6, and subtract line 7. Enter the result on line 8

1727 20

Line 9: (UI Only report) Enter the amount from line 8

JAN

FEB

MAR

4

4

3

Number of Workers by Month: Enter the number of employees who

007654321

worked on or received pay on the 12

of the month

th

000010

1

5000 00

.0088

44 00

Workers’ Compensation Filing

236115C

1

11673 51

.0560

653 72

Column 9A: NAICS/Class Codes assigned to the account (to be used

236115

4

13978 90

.0560

782 82

in A5 of the Employee Wage Listing)

0

Column 9B: Enter the number of employees for each NAICS/Class

0

Code

Column 9C: Enter the total wages for each NAICS/Class Code. (Use

0

the WC Average Wage of $11,673.51 for 2016 to report Corp. Officer

0

wages if the NAICS/Class Code ends in the letter C)

0

Column 9E: Multiply each wage amount from column 9C by the

6

30562 41

1480 54

Rate(s) in 9D and enter the results for each line

0

Line 10: Enter totals for columns 9B, 9C, and 9E

Line 11, Line 12, and Line 13: Enter as necessary

0

4/15/16

0

1480 54

307-123-4567

Line 14: Enter the total Workers’ Compensation tax due

1727 20

Joe Sample

Line 15: Enter the total Unemployment tax due from Line 8 above

3207 74

Line 16: Enter the results of Line 14 plus Line 15

President

This is the amount of payment that should be sent for UI and WC taxes

Make Checks payable to: Department of Workforce Services

** Excess wages are any wages for an Employee over the taxable wage base for the year. The Taxable Wage Base for 2016 is $25,500.00

Note: Once the taxable wage base has been met, excess wages cannot exceed the quarter’s total wage for the employee. To correct or file reports for a prior quarter

call (307) 235-3217 or visit our website at:

to obtain forms.

07WYS104066

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2