COUNTY OF KANE

COUNTY ASSESSMENT OFFICE

County Government Center

Mark D. Armstrong, CIAO

719 Batavia Avenue, Building C

Supervisor of Assessments

Geneva, Illinois 60134-3000

Holly A. Winter, CIAO/I

(630) 208-3818

Chief Deputy Supervisor of Assessments

MEMORANDUM

To:

All taxpayers with properties that suffered damage due to the floods of April 2013

From: Mark D. Armstrong, Kane County Supervisor of Assessments

Date: April 23, 2013

Re:

Property Tax Relief for flood-damaged structures

The Kane County Assessment Office is beginning the process of reassessing properties damaged

by the storms that hit the county in April 2013. Kane County Board Chairman Chris Lauzen and

Illinois Governor Pat Quinn have both declared Kane County to be a major disaster area, which

triggers the disaster area reassessment provisions of the Illinois Property Tax Code. This

includes Disaster Area Reassessment and the Natural Disaster Homestead Exemption.

Disaster Area Reassessment

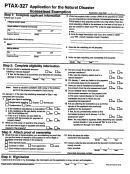

Disaster Area Reassessment provides that upon the declaration of a disaster area, any portion

of real property that was “substantially damaged by the disaster” may be eligible for

reassessment upon the filing of an application with the Kane County Assessment Office.

Taxpayers who believe they may be eligible for reassessment should fill out the form and return

it to the Kane County Assessment Office, which will then forward the application to the

respective Township Assessors.

The Township Assessors may contact applicants in order to evaluate the claims; persons filing

for disaster area reassessment should be prepared to show their Township Assessor evidence

of the loss in the form of receipts, insurance claims, photographs, or other evidence.

After the claims are processed, taxpayers will receive a notice from the Kane County Board of

Review. Those properties qualifying for a revised assessment will have their assessments

adjusted on a pro rata basis for the period from April 19 through the end of the year, as

provided by law.

Our Mission: An equitable assessment for every parcel.

1

1 2

2 3

3 4

4 5

5