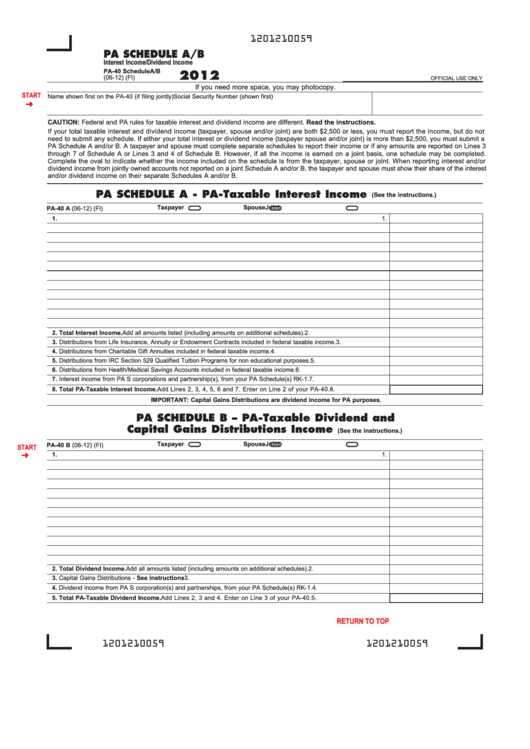

1201210059

PA SCHEDULE A/B

Interest Income/Dividend Income

PA-40 Schedule A/B

2012

(06-12) (FI)

OFFICIAL USE ONLY

If you need more space, you may photocopy.

START

Name shown first on the PA-40 (if filing jointly)

Social Security Number (shown first)

CAUTION: Federal and PA rules for taxable interest and dividend income are different. Read the instructions.

If your total taxable interest and dividend income (taxpayer, spouse and/or joint) are both $2,500 or less, you must report the income, but do not

need to submit any schedule. If either your total interest or dividend income (taxpayer spouse and/or joint) is more than $2,500, you must submit a

PA Schedule A and/or B. A taxpayer and spouse must complete separate schedules to report their income or if any amounts are reported on Lines 3

through 7 of Schedule A or Lines 3 and 4 of Schedule B. However, if all the income is earned on a joint basis, one schedule may be completed.

Complete the oval to indicate whether the income included on the schedule is from the taxpayer, spouse or joint. When reporting interest and/or

dividend income from jointly owned accounts not reported on a joint Schedule A and/or B, the taxpayer and spouse must show their share of the interest

and/or dividend income on their separate Schedules A and/or B.

PA SCHEDULE A - PA-Taxable Interest Income

(See the instructions.)

Taxpayer

Spouse

Joint

PA-40 A (06-12) (FI)

1.

1.

2. Total Interest Income. Add all amounts listed (including amounts on additional schedules).

2.

3. Distributions from Life Insurance, Annuity or Endowment Contracts included in federal taxable income.

3.

4. Distributions from Charitable Gift Annuities included in federal taxable income.

4.

5. Distributions from IRC Section 529 Qualified Tuition Programs for non educational purposes.

5.

6. Distributions from Health/Medical Savings Accounts included in federal taxable income.

6.

7. Interest income from PA S corporations and partnership(s), from your PA Schedule(s) RK-1.

7.

8. Total PA-Taxable Interest Income. Add Lines 2, 3, 4, 5, 6 and 7. Enter on Line 2 of your PA-40.

8.

IMPORTANT: Capital Gains Distributions are dividend income for PA purposes.

PA SCHEDULE B – PA-Taxable Dividend and

Capital Gains Distributions Income

(See the instructions.)

Taxpayer

Spouse

Joint

PA-40 B (06-12) (FI)

START

1.

1.

2. Total Dividend Income. Add all amounts listed (including amounts on additional schedules).

2.

3. Capital Gains Distributions - See instructions

3.

4. Dividend income from PA S corporation(s) and partnerships, from your PA Schedule(s) RK-1.

4.

5. Total PA-Taxable Dividend Income. Add Lines 2, 3 and 4. Enter on Line 3 of your PA-40.

5.

PRINT FORM

Reset Entire Form

RETURN TO TOP

1201210059

1201210059

1

1