Step-By-Step Instructions For Filling In Your Form G-45 (Periodic Return)

ADVERTISEMENT

(REV. 2012)

General Excise/Use One-Time Event

STEP-BY-STEP INSTRUCTIONS FOR FILLING IN YOUR

FORM G-45 (PERIODIC RETURN)

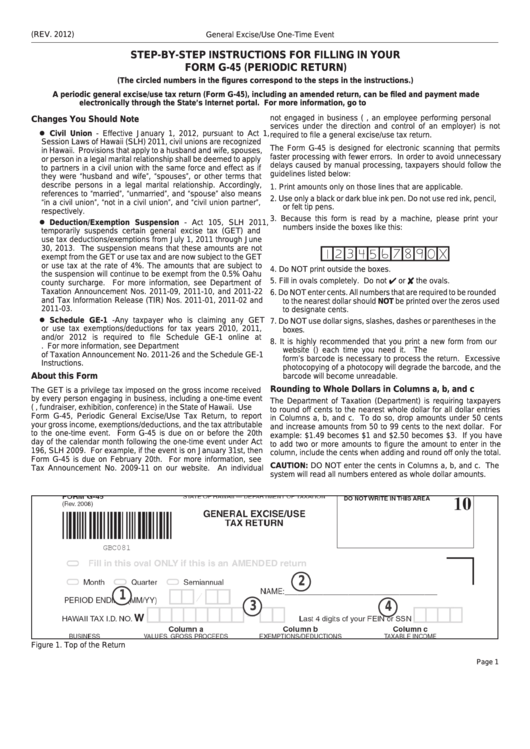

(The circled numbers in the figures correspond to the steps in the instructions.)

A periodic general excise/use tax return (Form G-45), including an amended return, can be filed and payment made

electronically through the State’s Internet portal. For more information, go to

not engaged in business (e.g., an employee performing personal

Changes You Should Note

services under the direction and control of an employer) is not

z Civil Union - Effective January 1, 2012, pursuant to Act 1,

required to file a general excise/use tax return.

Session Laws of Hawaii (SLH) 2011, civil unions are recognized

The Form G-45 is designed for electronic scanning that permits

in Hawaii. Provisions that apply to a husband and wife, spouses,

faster processing with fewer errors. In order to avoid unnecessary

or person in a legal marital relationship shall be deemed to apply

delays caused by manual processing, taxpayers should follow the

to partners in a civil union with the same force and effect as if

guidelines listed below:

they were “husband and wife”, “spouses”, or other terms that

describe persons in a legal marital relationship. Accordingly,

1. Print amounts only on those lines that are applicable.

references to “married”, “unmarried”, and “spouse” also means

2. Use only a black or dark blue ink pen. Do not use red ink, pencil,

“in a civil union”, “not in a civil union”, and “civil union partner”,

or felt tip pens.

respectively.

3. Because this form is read by a machine, please print your

z Deduction/Exemption Suspension - Act 105, SLH 2011,

numbers inside the boxes like this:

temporarily suspends certain general excise tax (GET) and

use tax deductions/exemptions from July 1, 2011 through June

30, 2013. The suspension means that these amounts are not

1234567890x

exempt from the GET or use tax and are now subject to the GET

or use tax at the rate of 4%. The amounts that are subject to

4. Do NOT print outside the boxes.

the suspension will continue to be exempt from the 0.5% Oahu

5. Fill in ovals completely. Do not 4 or 8 the ovals.

county surcharge. For more information, see Department of

Taxation Announcement Nos. 2011-09, 2011-10, and 2011-22

6. Do NOT enter cents. All numbers that are required to be rounded

and Tax Information Release (TIR) Nos. 2011-01, 2011-02 and

to the nearest dollar should NOT be printed over the zeros used

2011-03.

to designate cents.

z Schedule GE-1 - Any taxpayer who is claiming any GET

7. Do NOT use dollar signs, slashes, dashes or parentheses in the

or use tax exemptions/deductions for tax years 2010, 2011,

boxes.

and/or 2012 is required to file Schedule GE-1 online at

8. It is highly recommended that you print a new form from our

For more information, see Department

website ( ) each time you need it. The

of Taxation Announcement No. 2011-26 and the Schedule GE-1

form’s barcode is necessary to process the return. Excessive

Instructions.

photocopying of a photocopy will degrade the barcode, and the

About this Form

barcode will become unreadable.

Rounding to Whole Dollars in Columns a, b, and c

The GET is a privilege tax imposed on the gross income received

by every person engaging in business, including a one-time event

The Department of Taxation (Department) is requiring taxpayers

(e.g., fundraiser, exhibition, conference) in the State of Hawaii. Use

to round off cents to the nearest whole dollar for all dollar entries

Form G-45, Periodic General Excise/Use Tax Return, to report

in Columns a, b, and c. To do so, drop amounts under 50 cents

your gross income, exemptions/deductions, and the tax attributable

and increase amounts from 50 to 99 cents to the next dollar. For

to the one-time event. Form G-45 is due on or before the 20th

example: $1.49 becomes $1 and $2.50 becomes $3. If you have

day of the calendar month following the one-time event under Act

to add two or more amounts to figure the amount to enter in the

196, SLH 2009. For example, if the event is on January 31st, then

column, include the cents when adding and round off only the total.

Form G-45 is due on February 20th. For more information, see

CAUTION: DO NOT enter the cents in Columns a, b, and c. The

Tax Announcement No. 2009-11 on our website. An individual

system will read all numbers entered as whole dollar amounts.

2

1

3

4

Figure 1. Top of the Return

Page 1

5

6

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11