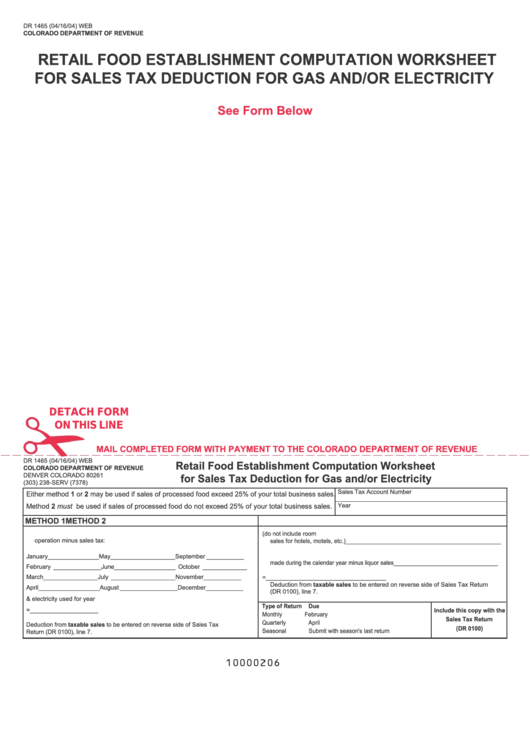

DR 1465 (04/16/04) WEB

COLORADO DEPARTMENT OF REVENUE

RETAIL FOOD ESTABLISHMENT COMPUTATION WORKSHEET

FOR SALES TAX DEDUCTION FOR GAS AND/OR ELECTRICITY

See Form Below

DETACH FORM

ON THIS LINE

MAIL COMPLETED FORM WITH PAYMENT TO THE COLORADO DEPARTMENT OF REVENUE

DR 1465 (04/16/04) WEB

Retail Food Establishment Computation Worksheet

COLORADO DEPARTMENT OF REVENUE

DENVER COLORADO 80261

for Sales Tax Deduction for Gas and/or Electricity

(303) 238-SERV (7378)

Sales Tax Account Number

Either method 1 or 2 may be used if sales of processed food exceed 25% of your total business sales.

Year

Method 2 must be used if sales of processed food do not exceed 25% of your total business sales.

METHOD 1

METHOD 2

1. Monthly cost of gas and electricity used for restaurant

1. Total sales for year (do not include room

operation minus sales tax:

sales for hotels, motels, etc.) _______________________________________________

2. Processed food sales for immediate consumption

January _______________ May ___________________ September ___________

made during the calendar year minus liquor sales _________________________________

February ______________ June __________________ October _____________

March ________________ July ___________________ November ___________

3. Amount on line 2 ___________ X .005 = ____________________________________

Deduction from taxable sales to be entered on reverse side of Sales Tax Return

April __________________ August _________________ December ___________

(DR 0100), line 7.

2. Total cost of gas & electricity used for year

Type of Return

Due

3. Amount on line 2 _______________________ X .55 = ____________________

Include this copy with the

Monthly

February

Sales Tax Return

Quarterly

April

Deduction from taxable sales to be entered on reverse side of Sales Tax

(DR 0100)

Seasonal

Submit with season's last return

Return (DR 0100), line 7.

1

1