Massachusetts Department of Revenue

PO Box 7011

Sales Tax Unit

Boston, MA 02204-7011

Important Information Regarding Prepaid Sales Tax on Tobacco Products

Due to recent legislation, effective September 1, 2008, every person selling tobacco products (cigarettes, cigars, smoking tobacco,

and smokeless tobacco) to others for resale in Massachusetts must prepay the sales tax on such products held for retail sale. The

sales tax will be calculated on each sale by multiplying the price at which such person sells the tobacco products at wholesale by the

5% sales tax rate. The amount of the sales tax must be separately stated on the customer invoice or other record. See TIR 08-9

for more information.

Wholesalers should not deduct any sales of tobacco products for which a prepaid sales tax has been passed on to their custom-

ers on line 2 of their sales tax return. These sales should be entered along with all other taxable sales for the month on line 4.

Tobacco retailers will continue to collect sales tax on their sales of all tobacco products as well as other taxable items. The new

law allows a retailer of tobacco products a credit on line 8 of their sales tax return in the amount of the prepaid sales tax made to

their suppliers against the total amount of sales tax that would normally be due by the retailer for that period.

As result of this new law, the sales tax returns you previously received should be discarded. Beginning with the September 2008

return you must use the enclosed sales tax returns for the remainder of the year.

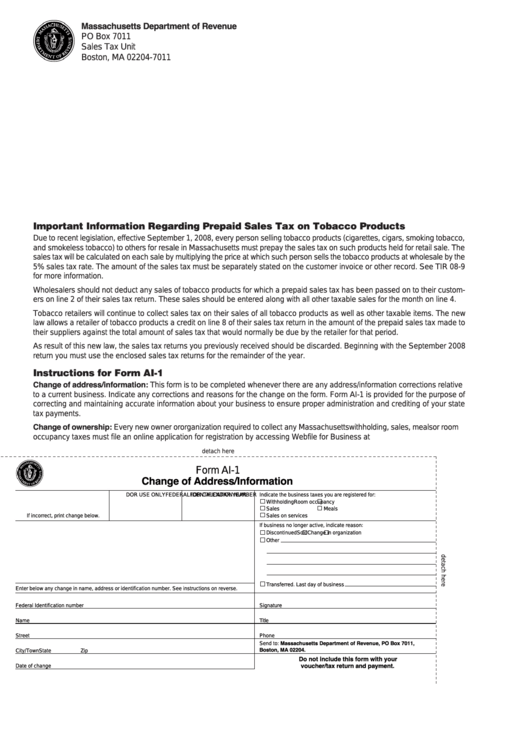

Instructions for Form AI-1

Change of address/information: This form is to be completed whenever there are any address/information corrections relative

to a current business. Indicate any corrections and reasons for the change on the form. Form AI-1 is provided for the purpose of

correcting and maintaining accurate information about your business to ensure proper administration and crediting of your state

tax payments.

Change of ownership: Every new owner or organization required to collect any Massachusetts withholding, sales, meals or room

occupancy taxes must file an online application for registration by accessing Webfile for Business at

detach here

Form AI-1

Change of Address/Information

FEDERAL IDENTIFICATION NUMBER

DOR USE ONLY

FOR CALENDAR YEAR

Indicate the business taxes you are registered for:

Withholding

Room occupancy

Sales

Meals

If incorrect, print change below.

Sales on services

If business no longer active, indicate reason:

Discontinued

Sold

Change in organization

Other

Transferred. Last day of business

Enter below any change in name, address or identification number. See instructions on reverse.

Federal Identification number

Signature

Name

Title

Street

Phone no.

Date

Send to: Massachusetts Department of Revenue, PO Box 7011,

Boston, MA 02204.

City/Town

State

Zip

Do not include this form with your

voucher/tax return and payment.

Date of change

1

1 2

2 3

3