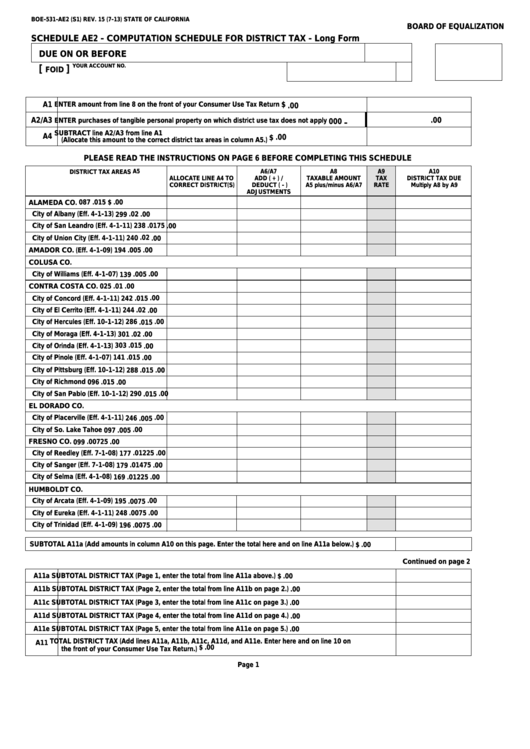

BOE-531-AE2 (S1) REV. 15 (7-13)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

SCHEDULE AE2 - COMPUTATION SCHEDULE FOR DISTRICT TAX - Long Form

DUE ON OR BEFORE

YOUR ACCOUNT NO.

[

]

FOID

A1

$

ENTER amount from line 8 on the front of your Consumer Use Tax Return

.00

A2/A3

.00

ENTER purchases of tangible personal property on which district use tax does not apply

000

-

SUBTRACT line A2/A3 from line A1

A4

.00

$

(Allocate this amount to the correct district tax areas in column A5.)

PLEASE READ THE INSTRUCTIONS ON PAGE 6 BEFORE COMPLETING THIS SCHEDULE

A5

A6/A7

A8

A9

A10

DISTRICT TAX AREAS

ALLOCATE LINE A4 TO

ADD ( + ) /

TAXABLE AMOUNT

TAX

DISTRICT TAX DUE

CORRECT DISTRICT(S)

DEDUCT ( - )

A5 plus/minus A6/A7

RATE

Multiply A8 by A9

ADJUSTMENTS

$

.00

087

.015

ALAMEDA CO.

City of Albany (Eff. 4-1-13)

.00

.02

299

City of San Leandro (Eff. 4-1-11)

.00

238

.0175

City of Union City (Eff. 4-1-11)

.02

.00

240

.00

AMADOR CO. (Eff. 4-1-09)

194

.005

COLUSA CO.

City of Williams (Eff. 4-1-07)

.00

.005

139

.00

CONTRA COSTA CO.

025

.01

.00

City of Concord (Eff. 4-1-11)

242

.015

City of El Cerrito (Eff. 4-1-11)

.00

244

.02

City of Hercules (Eff. 10-1-12)

.00

286

.015

City of Moraga (Eff. 4-1-13)

.00

301

.02

City of Orinda (Eff. 4-1-13)

303

.00

.015

City of Pinole (Eff. 4-1-07)

.00

141

.015

City of Pittsburg (Eff. 10-1-12)

.00

288

.015

City of Richmond

.00

096

.015

City of San Pablo (Eff. 10-1-12)

.00

290

.015

EL DORADO CO.

City of Placerville (Eff. 4-1-11)

.00

246

.005

City of So. Lake Tahoe

.00

097

.005

FRESNO CO.

.00

.00725

099

City of Reedley (Eff. 7-1-08)

.00

.01225

177

City of Sanger (Eff. 7-1-08)

.00

.01475

179

City of Selma (Eff. 4-1-08)

.00

169

.01225

HUMBOLDT CO.

.00

City of Arcata (Eff. 4-1-09)

195

.0075

City of Eureka (Eff. 4-1-11)

.00

248

.0075

City of Trinidad (Eff. 4-1-09)

.00

196

.0075

SUBTOTAL A11a (Add amounts in column A10 on this page. Enter the total here and on line A11a below.)

$

.00

Continued on page 2

A11a

SUBTOTAL DISTRICT TAX (Page 1, enter the total from line A11a above.)

$

.00

A11b

SUBTOTAL DISTRICT TAX (Page 2, enter the total from line A11b on page 2.)

.00

A11c

SUBTOTAL DISTRICT TAX (Page 3, enter the total from line A11c on page 3.)

.00

A11d

SUBTOTAL DISTRICT TAX (Page 4, enter the total from line A11d on page 4.)

.00

A11e

SUBTOTAL DISTRICT TAX (Page 5, enter the total from line A11e on page 5.)

.00

TOTAL DISTRICT TAX (Add lines A11a, A11b, A11c, A11d, and A11e. Enter here and on line 10 on

A11

$

.00

the front of your Consumer Use Tax Return.)

Page 1

1

1 2

2 3

3 4

4 5

5 6

6