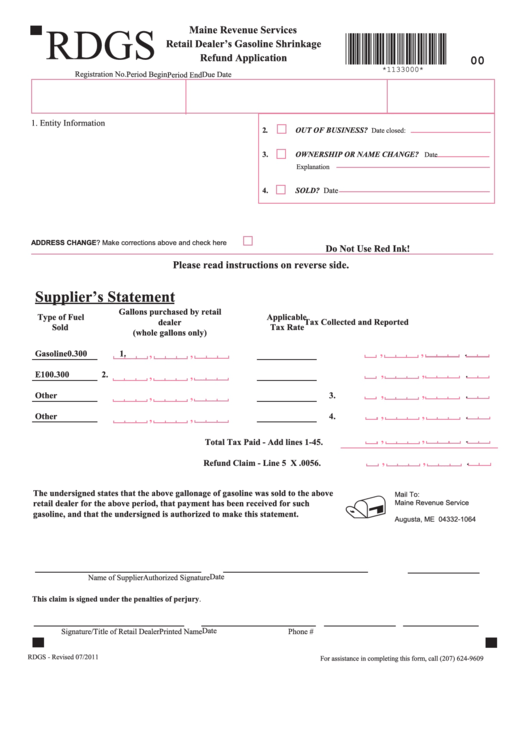

Form Rdgs - Retail Dealer'S Gasoline Shrinkage Refund Application

ADVERTISEMENT

RDGS

Maine Revenue Services

Retail Dealer’s Gasoline Shrinkage

00

Refund Application

*1133000*

Registration No.

Period Begin

Due Date

Period End

1. Entity Information

2.

OUT OF BUSINESS?

Date closed:

3.

OWNERSHIP OR NAME CHANGE?

Date

Explanation

4.

SOLD? Date

ADDRESS CHANGE? Make corrections above and check here

Do Not Use Red Ink!

Please read instructions on reverse side.

Supplier’s Statement

Gallons purchased by retail

Type of Fuel

Applicable

dealer

Tax Collected and Reported

Sold

Tax Rate

(whole gallons only)

,

,

.

,

,

Gasoline

0.300

1.

,

,

.

E10

0.300

2.

,

,

,

,

.

Other

,

,

3.

,

,

.

Other

4.

,

,

,

,

.

Total Tax Paid - Add lines 1-4

5.

,

,

.

Refund Claim - Line 5 X .005

6.

The undersigned states that the above gallonage of gasoline was sold to the above

Mail To:

/

retail dealer for the above period, that payment has been received for such

Maine Revenue Service

P.O. Box 1064

gasoline, and that the undersigned is authorized to make this statement.

Augusta, ME 04332-1064

Date

Name of Supplier

Authorized Signature

This claim is signed under the penalties of perjury.

Date

Signature/Title of Retail Dealer

Printed Name

Phone #

RDGS - Revised 07/2011

For assistance in completing this form, call (207) 624-9609

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2