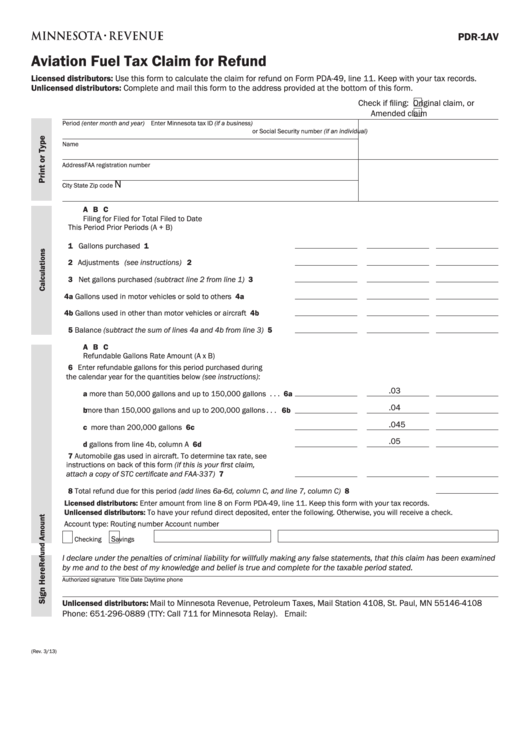

PDR-1AV

Aviation Fuel Tax Claim for Refund

Licensed distributors: Use this form to calculate the claim for refund on Form PDA-49, line 11 . Keep with your tax records .

Unlicensed distributors: Complete and mail this form to the address provided at the bottom of this form .

Check if filing:

Original claim, or

Amended claim

Period (enter month and year)

Enter Minnesota tax ID (if a business)

or Social Security number (if an individual)

Name

Address

FAA registration number

N

City

State

Zip code

A

B

C

Filing for

Filed for

Total Filed to Date

This Period

Prior Periods

(A + B)

1 Gallons purchased . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Adjustments (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Net gallons purchased (subtract line 2 from line 1) . . . . . . . . . . 3

4a Gallons used in motor vehicles or sold to others . . . . . . . . . . . 4a

4b Gallons used in other than motor vehicles or aircraft . . . . . . . 4b

5 Balance (subtract the sum of lines 4a and 4b from line 3) . . . . 5

A

B

C

Refundable Gallons

Rate

Amount (A x B)

6 Enter refundable gallons for this period purchased during

the calendar year for the quantities below (see instructions):

.03

a more than 50,000 gallons and up to 150,000 gallons . . . 6a

.04

b more than 150,000 gallons and up to 200,000 gallons . . . 6b

.045

c more than 200,000 gallons . . . . . . . . . . . . . . . . . . . . . . . . . 6c

.05

d gallons from line 4b, column A . . . . . . . . . . . . . . . . . . . . . . . 6d

7 Automobile gas used in aircraft . To determine tax rate, see

instructions on back of this form (if this is your first claim,

attach a copy of STC certificate and FAA-337) . . . . . . . . . . . . . . 7

8 Total refund due for this period (add lines 6a-6d, column C, and line 7, column C) . . . . . . . . . . . . . . . . . . . . 8

Licensed distributors: Enter amount from line 8 on Form PDA-49, line 11 . Keep this form with your tax records .

Unlicensed distributors: To have your refund direct deposited, enter the following . Otherwise, you will receive a check .

Account type:

Routing number

Account number

S

Checking

avings

I declare under the penalties of criminal liability for willfully making any false statements, that this claim has been examined

by me and to the best of my knowledge and belief is true and complete for the taxable period stated.

Authorized signature

Title

Date

Daytime phone

Mail to Minnesota Revenue, Petroleum Taxes, Mail Station 4108, St . Paul, MN 55146-4108

Unlicensed distributors:

Phone: 651-296-0889 (TTY: Call 711 for Minnesota Relay) . Email: petroleum .tax@state .mn .us

(Rev . 3/13)

1

1 2

2