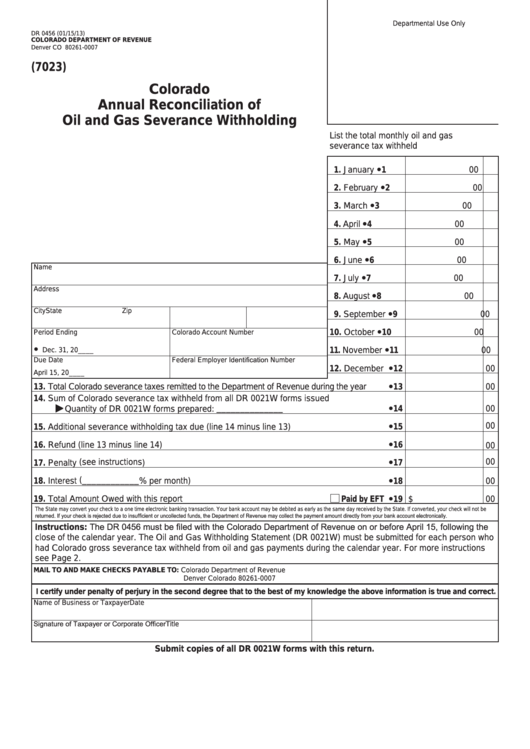

Departmental Use Only

DR 0456 (01/15/13)

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0007

(7023)

Colorado

Annual Reconciliation of

Oil and Gas Severance Withholding

List the total monthly oil and gas

severance tax withheld

•

1. January

1

00

•

2. February

2

00

•

3. March

3

00

•

4. April

4

00

•

5. May

5

00

•

6. June

6

00

Name

•

7. July

7

00

Address

•

8. August

8

00

•

City

State

Zip

9. September

9

00

•

10. October

10

00

Period Ending

Colorado Account Number

•

•

Dec. 31, 20____

11. November

11

00

Due Date

Federal Employer Identification Number

•

12. December

12

00

April 15, 20____

•

13. Total Colorado severance taxes remitted to the Department of Revenue during the year

13

00

14. Sum of Colorado severance tax withheld from all DR 0021W forms issued

•

Quantity of DR 0021W forms prepared: ______________

14

00

•

00

15. Additional severance withholding tax due (line 14 minus line 13)

15

•

16. Refund (line 13 minus line 14)

16

00

•

17. Penalty (see instructions )

00

17

•

18. Interest (____________ % per month)

18

00

•

19. Total Amount Owed with this report

Paid by EFT

19 $

00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your check will not be

returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account electronically.

Instructions: The DR 0456 must be filed with the Colorado Department of Revenue on or before April 15, following the

close of the calendar year. The Oil and Gas Withholding Statement (DR 0021W) must be submitted for each person who

had Colorado gross severance tax withheld from oil and gas payments during the calendar year. For more instructions

see Page 2.

MAIL TO AND MAKE CHECKS PAYABLE TO: Colorado Department of Revenue

Denver Colorado 80261-0007

I certify under penalty of perjury in the second degree that to the best of my knowledge the above information is true and correct.

Name of Business or Taxpayer

Date

Signature of Taxpayer or Corporate Officer

Title

Submit copies of all DR 0021W forms with this return.

1

1 2

2