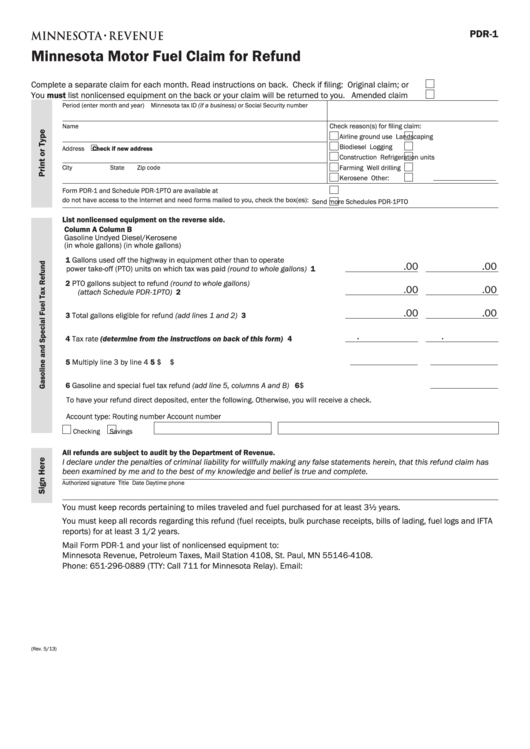

PDR-1

Minnesota Motor Fuel Claim for Refund

Complete a separate claim for each month. Read instructions on back.

Check if filing:

Original claim; or

You must list nonlicensed equipment on the back or your claim will be returned to you.

Amended claim

Period (enter month and year)

Minnesota tax ID (if a business) or Social Security number

Name

Check reason(s) for filing claim:

Airline ground use

Landscaping

Biodiesel

Logging

Address

Check if new address

Construction

Refrigeration units

Farming

Well drilling

City

State

Zip code

Kerosene

Other:

Form PDR-1 and Schedule PDR-1PTO are available at If you

Send more Forms PDR-1

do not have access to the Internet and need forms mailed to you, check the box(es):

Send more Schedules PDR-1PTO

List nonlicensed equipment on the reverse side.

Column A

Column B

Gasoline

Undyed Diesel/Kerosene

(in whole gallons)

(in whole gallons)

1 Gallons used off the highway in equipment other than to operate

.00

.00

power take-off (PTO) units on which tax was paid (round to whole gallons) . . . . 1

2 PTO gallons subject to refund (round to whole gallons)

.00

.00

(attach Schedule PDR-1PTO) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

.00

3 Total gallons eligible for refund (add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . 3

.

.

4 Tax rate (determine from the instructions on back of this form) . . . . . . . . . . . . 4

5 Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 $

$

6 Gasoline and special fuel tax refund (add line 5, columns A and B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 $

To have your refund direct deposited, enter the following. Otherwise, you will receive a check.

Account type:

Routing number

Account number

Checking

Savings

All refunds are subject to audit by the Department of Revenue.

I declare under the penalties of criminal liability for willfully making any false statements herein, that this refund claim has

been examined by me and to the best of my knowledge and belief is true and complete.

Authorized signature

Title

Date

Daytime phone

You must keep records pertaining to miles traveled and fuel purchased for at least 3½ years.

You must keep all records regarding this refund (fuel receipts, bulk purchase receipts, bills of lading, fuel logs and IFTA

reports) for at least 3 1/2 years.

Mail Form PDR-1 and your list of nonlicensed equipment to:

Minnesota Revenue, Petroleum Taxes, Mail Station 4108, St. Paul, MN 55146-4108.

Phone: 651-296-0889 (TTY: Call 711 for Minnesota Relay). Email: petroleum.tax@state.mn.us

(Rev. 5/13)

1

1 2

2