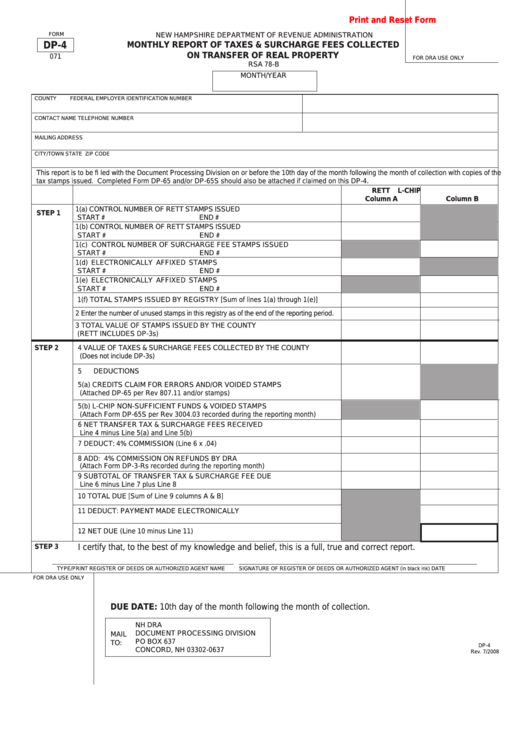

Print and Reset Form

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-4

MONTHLY REPORT OF TAXES & SURCHARGE FEES COLLECTED

ON TRANSFER OF REAL PROPERTY

071

FOR DRA USE ONLY

RSA 78-B

MONTH/YEAR

COUNTY

FEDERAL EMPLOYER IDENTIFICATION NUMBER

CONTACT NAME

TELEPHONE NUMBER

MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

This report is to be fi led with the Document Processing Division on or before the 10th day of the month following the month of collection with copies of the

tax stamps issued. Completed Form DP-65 and/or DP-65S should also be attached if claimed on this DP-4.

RETT

L-CHIP

Column A

Column B

1(a) CONTROL NUMBER OF RETT STAMPS ISSUED

STEP 1

START #

END #

1(b) CONTROL NUMBER OF RETT STAMPS ISSUED

START #

END #

1(c) CONTROL NUMBER OF SURCHARGE FEE STAMPS ISSUED

START #

END #

1(d) ELECTRONICALLY AFFIXED STAMPS

START #

END #

1(e) ELECTRONICALLY AFFIXED STAMPS

START #

END #

1(f) TOTAL STAMPS ISSUED BY REGISTRY [Sum of lines 1(a) through 1(e)]

2

Enter the number of unused stamps in this registry as of the end of the reporting period.

3

TOTAL VALUE OF STAMPS ISSUED BY THE COUNTY

(RETT INCLUDES DP-3s)

4

VALUE OF TAXES & SURCHARGE FEES COLLECTED BY THE COUNTY

STEP 2

(Does not include DP-3s)

5

DEDUCTIONS

5(a) CREDITS CLAIM FOR ERRORS AND/OR VOIDED STAMPS

(Attached DP-65 per Rev 807.11 and/or stamps)

5(b) L-CHIP NON-SUFFICIENT FUNDS & VOIDED STAMPS

(Attach Form DP-65S per Rev 3004.03 recorded during the reporting month)

6

NET TRANSFER TAX & SURCHARGE FEES RECEIVED

Line 4 minus Line 5(a) and Line 5(b)

7

DEDUCT: 4% COMMISSION (Line 6 x .04)

8

ADD: 4% COMMISSION ON REFUNDS BY DRA

(Attach Form DP-3-Rs recorded during the reporting month)

9

SUBTOTAL OF TRANSFER TAX & SURCHARGE FEE DUE

Line 6 minus Line 7 plus Line 8

10

TOTAL DUE [Sum of Line 9 columns A & B]

11

DEDUCT: PAYMENT MADE ELECTRONICALLY

12

NET DUE (Line 10 minus Line 11)

STEP 3

I certify that, to the best of my knowledge and belief, this is a full, true and correct report.

TYPE/PRINT REGISTER OF DEEDS OR AUTHORIZED AGENT NAME

SIGNATURE OF REGISTER OF DEEDS OR AUTHORIZED AGENT (in black ink)

DATE

FOR DRA USE ONLY

DUE DATE:

10th day of the month following the month of collection.

NH DRA

DOCUMENT PROCESSING DIVISION

MAIL

PO BOX 637

TO:

DP-4

CONCORD, NH 03302-0637

Rev. 7/2008

1

1 2

2