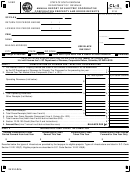

FORM

NEW HAMPSHIRE DEPARTMENT OF REVENUE ADMINISTRATION

DP-4

MONTHLY REPORT OF TAXES COLLECTED

ON TRANSFER OF REAL PROPERTY

General Instructions

WHO MUST FILE

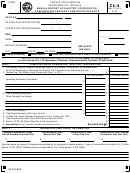

LINE 2 Enter the number of unused stamps on hand at the Registry as

Pursuant to RSA 79-B:8,II "...each register of deeds shall remit the taxes so

of the end of the reporting period.

collected, minus payment for his services to the department monthly...."

LINE 3 Enter the total value of stamps issued by the county in this

WHEN TO FILE

reporting period. Include, if applicable, any stamps issued as a result

Pursuant to Rev 809.01(d), and Rev 3004.02, Form DP-4 shall be fi led on

of a Department-issued DP-3. Attach Form DP-3s recorded during the

or before the 10th day of the month following the month of collection.

reporting month.

WHERE TO FILE

STEP 2

MAIL TO: NH DEPT OF REVENUE ADMINISTRATION (NH DRA),

DOCUMENT PROCESSING DIVISION, PO BOX 637, CONCORD, NH

LINE 4 Enter the value of taxes and surcharge fees collected by the

03302-0637.

county. This does not include taxes reported on the DP-3, if applicable.

FORMS MAY NOT BE FILED BY FAX. Payments may also be sent

LINE 5(a) Deduct the value of taxes collected and attributable to

electronically on our web at

voided RETT stamps. Attach the voided stamps or a completed Form

DP-65.

NEED HELP?

Call Customer Service at (603) 271-2191, Monday through Friday, 8:00

LINE 5(b) Deduct value of fees collected and attributable to non-

am - 4:30 pm.

suffi cient funds and voided stamps for L-CHIP surcharge. Attach Form

DP-65S Credit Claim for Recording Surcharge Stamps or Indicia.

NEED FORMS?

To obtain additional forms you may access our web site at

LINE 6 Enter the result of Line 4 minus Line 5(a) and 5(b).

revenue or call the forms line at (6703) 271-2192.

LINE 7 Calculate the 4% commission due your Registry by multiplying

ADA COMPLIANCE

.04 x Line 6 amount. Enter the result on Line 7, Columns A & B.

Individuals who need auxiliary aids for effective communications in

programs and services of the New Hampshire Department of Revenue

LINE 8 If applicable, enter amount of 4% commission due DRA as a

Administration are invited to make their needs and preferences known.

result of a Department refund as reported to you on Form DP-3R.Attach

Individuals with hearing or speech impairments may call TDD Access:

DP-3Rs recorded during the reporting month.

Relay NH 1-800-735-2964.

LINE 9 Calculate Subtotal of tax and surcharge fee due. Line 6 minus

DP-3s

Line 7 plus Line 8. Enter the result on Line 9, Columns A & B.

When the Department receives payment of additional real estate transfer

tax collected, it will send to the affected registry in the following month a

LINE 10 Total Line 9, columns A & B, enter amount on Line 10 column

completed Form DP-3 for each taxpayer.

B.

DP-3Rs

LINE 11 If applicable, deduct electronically fi led payments made by

When the Department refunds real estate transfer tax collected to a

your Registry for this reporting period.

taxpayer, it will send a completed form DP-3R to the affected Registry in

the month following the refund.

LINE 12 Calculate net tax due: Line 10 minus Line 11. Enclose but do

not staple or tape, check payable to State of New Hampshire.

DP-65

Pursuant to Rev 809.06(a), Form DP65, Credit Claim for Real Estate

STEP 3

Transfer Tax Stamps or indicia erroneously issued and placed on a

Type or print the name of the Register or authorized agent completing this

recorded document shall be fi led with the Department for erroneously

form. The original signature of Register or authorized agent and date are

issued tax stamps or indicia.

required to certify this report is full, true, and correct.

DP-65S

Pursuant to Rev 3004.03(a), Form DP-65S Credit Claim for Recording

Surcharge Stamps or Indicia, shall be fi led to report to the Department

insuffi cient funds related to the L-CHIP surcharge for documents recorded

and to report L-CHIP stamps erroneously issued or voided.

COUNTY NAME & ADDRESS

Enter the county information including the Federal Employer

Identifi cation Number, contact name, telephone number, mailing

address, city/town, state and zip code.

STEP 1

LINE 1(a) Enter the beginning control number and ending control number

of the real estate transfer tax stamps used during the reporting period

and corresponding values.

LINE 1(b) If the stamps used are numbered out of sequence enter the

beginning and ending numbers of the second set of stamps used and

corresponding values.

LINE 1(c) Enter the beginning control number and ending control

number of the surcharge fee stamps used during the reporting period

and corresponding values.

LINE 1(d) and 1(e) If applicable, enter the electronically affi xed stamps

issued during the reporting period and corresponding values.

LINE 1(f) Enter the sum of Lines 1(a), 1(b), 1(c), 1(d) and 1(e).

DP-4

Rev. 7/2008

1

1 2

2