Clear Form

For Tax Year

CLAIM OF RIGHT

CR

INCOME REPAYMENTS

ORS 315.068

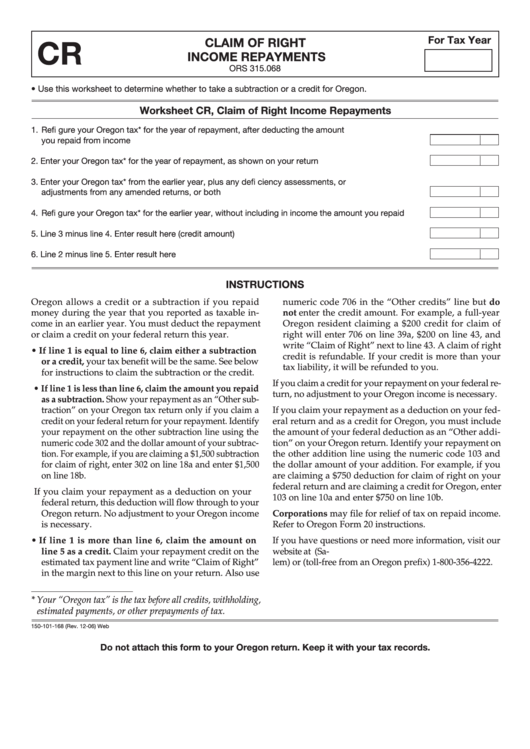

• Use this worksheet to determine whether to take a subtraction or a credit for Oregon.

Worksheet CR, Claim of Right Income Repayments

1. Refi gure your Oregon tax* for the year of repayment, after deducting the amount

you repaid from income .............................................................................................................................. 1

2. Enter your Oregon tax* for the year of repayment, as shown on your return ........................................... 2

3. Enter your Oregon tax* from the earlier year, plus any defi ciency assessments, or

adjustments from any amended returns, or both ....................................................................................... 3

4. Refi gure your Oregon tax* for the earlier year, without including in income the amount you repaid ....... 4

5. Line 3 minus line 4. Enter result here (credit amount) ................................................................................ 5

6. Line 2 minus line 5. Enter result here ......................................................................................................... 6

INSTRUCTIONS

Oregon allows a credit or a subtraction if you repaid

numeric code 706 in the “Other credits” line but do

money during the year that you reported as taxable in-

not enter the credit amount. For example, a full-year

come in an earlier year. You must deduct the repayment

Oregon resident claiming a $200 credit for claim of

or claim a credit on your federal return this year.

right will enter 706 on line 39a, $200 on line 43, and

write “Claim of Right” next to line 43. A claim of right

• If line 1 is equal to line 6, claim either a subtraction

credit is refundable. If your credit is more than your

or a credit, your tax benefit will be the same. See below

tax liability, it will be refunded to you.

for instructions to claim the subtraction or the credit.

If you claim a credit for your repayment on your federal re-

• If line 1 is less than line 6, claim the amount you repaid

turn, no adjustment to your Oregon income is necessary.

as a subtraction. Show your repayment as an “Other sub-

traction” on your Oregon tax return only if you claim a

If you claim your repayment as a deduction on your fed-

credit on your federal return for your repayment. Identify

eral return and as a credit for Oregon, you must include

your repayment on the other subtraction line using the

the amount of your federal deduction as an “Other addi-

numeric code 302 and the dollar amount of your subtrac-

tion” on your Oregon return. Identify your repayment on

tion. For example, if you are claiming a $1,500 subtraction

the other addition line using the numeric code 103 and

for claim of right, enter 302 on line 18a and enter $1,500

the dollar amount of your addition. For example, if you

on line 18b.

are claiming a $750 deduction for claim of right on your

federal return and are claiming a credit for Oregon, enter

If you claim your repayment as a deduction on your

103 on line 10a and enter $750 on line 10b.

federal return, this deduction will flow through to your

Oregon return. No adjustment to your Oregon income

Corporations may file for relief of tax on repaid income.

is necessary.

Refer to Oregon Form 20 instructions.

• If line 1 is more than line 6, claim the amount on

If you have questions or need more information, visit our

line 5 as a credit. Claim your repayment credit on the

website at Or call 503-378-4988 (Sa-

estimated tax payment line and write “Claim of Right”

lem) or (toll-free from an Oregon prefix) 1-800-356-4222.

in the margin next to this line on your return. Also use

* Your “Oregon tax” is the tax before all credits, withholding,

estimated payments, or other prepayments of tax.

150-101-168 (Rev. 12-06) Web

Do not attach this form to your Oregon return. Keep it with your tax records.

1

1