Dd Form 2754 - Jrotc Instructor Pay Certification Worksheet For Entitlement Computation

ADVERTISEMENT

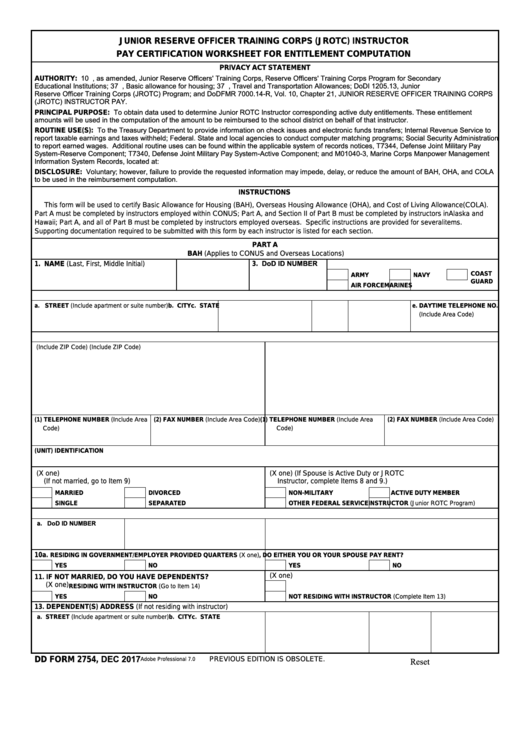

JUNIOR RESERVE OFFICER TRAINING CORPS (JROTC) INSTRUCTOR

PAY CERTIFICATION WORKSHEET FOR ENTITLEMENT COMPUTATION

PRIVACY ACT STATEMENT

AUTHORITY: 10 U.S.C. 2031, as amended, Junior Reserve Officers' Training Corps, Reserve Officers' Training Corps Program for Secondary

Educational Institutions; 37 U.S.C. 403, Basic allowance for housing; 37 U.S.C. 405, Travel and Transportation Allowances; DoDI 1205.13, Junior

Reserve Officer Training Corps (JROTC) Program; and DoDFMR 7000.14-R, Vol. 10, Chapter 21, JUNIOR RESERVE OFFICER TRAINING CORPS

(JROTC) INSTRUCTOR PAY.

PRINCIPAL PURPOSE: To obtain data used to determine Junior ROTC Instructor corresponding active duty entitlements. These entitlement

amounts will be used in the computation of the amount to be reimbursed to the school district on behalf of that instructor.

ROUTINE USE(S): To the Treasury Department to provide information on check issues and electronic funds transfers; Internal Revenue Service to

report taxable earnings and taxes withheld; Federal. State and local agencies to conduct computer matching programs; Social Security Administration

to report earned wages. Additional routine uses can be found within the applicable system of records notices, T7344, Defense Joint Military Pay

System-Reserve Component; T7340, Defense Joint Military Pay System-Active Component; and M01040-3, Marine Corps Manpower Management

Information System Records, located at:

DISCLOSURE: Voluntary; however, failure to provide the requested information may impede, delay, or reduce the amount of BAH, OHA, and COLA

to be used in the reimbursement computation.

INSTRUCTIONS

This form will be used to certify Basic Allowance for Housing (BAH), Overseas Housing Allowance (OHA), and Cost of Living Allowance (COLA).

Part A must be completed by instructors employed within CONUS; Part A, and Section II of Part B must be completed by instructors in Alaska and

Hawaii; Part A, and all of Part B must be completed by instructors employed overseas. Specific instructions are provided for several items.

Supporting documentation required to be submitted with this form by each instructor is listed for each section.

PART A

BAH (Applies to CONUS and Overseas Locations)

3. DoD ID NUMBER

1. NAME (Last, First, Middle Initial)

2. RETIRED GRADE

4. BRANCH OF SERVICE RETIRED FROM

COAST

ARMY

NAVY

GUARD

AIR FORCE

MARINES

5. CURRENT ADDRESS OF INSTRUCTOR

a. STREET (Include apartment or suite number)

b. CITY

c. STATE

d. ZIP CODE

e. DAYTIME TELEPHONE NO.

(Include Area Code)

6. EMPLOYING SCHOOL INFORMATION

a. NAME AND ADDRESS OF SCHOOL (Include ZIP Code)

b. NAME AND ADDRESS OF SCHOOL DISTRICT (Include ZIP Code)

(1) TELEPHONE NUMBER (Include Area

(2) FAX NUMBER (Include Area Code)

(1) TELEPHONE NUMBER (Include Area

(2) FAX NUMBER (Include Area Code)

Code)

Code)

c. SCHOOL (UNIT) IDENTIFICATION

7. MARITAL STATUS (X one)

8. STATUS OF SPOUSE (X one) (If Spouse is Active Duty or JROTC

(If not married, go to Item 9)

Instructor, complete Items 8 and 9.)

MARRIED

DIVORCED

NON-MILITARY

ACTIVE DUTY MEMBER

SINGLE

SEPARATED

OTHER FEDERAL SERVICE

INSTRUCTOR (Junior ROTC Program)

9. IF SPOUSE IS ACTIVE DUTY OR INSTRUCTOR

a. DoD ID NUMBER

b. BRANCH OF SERVICE

c. DUTY LOCATION

10a.

RESIDING IN GOVERNMENT/EMPLOYER PROVIDED QUARTERS (X one)

b. IF YES, DO EITHER YOU OR YOUR SPOUSE PAY RENT?

YES

NO

YES

NO

12. DEPENDENT STATUS (X one)

11. IF NOT MARRIED, DO YOU HAVE DEPENDENTS?

(X one)

RESIDING WITH INSTRUCTOR (Go to Item 14)

YES

NO

NOT RESIDING WITH INSTRUCTOR (Complete Item 13)

13. DEPENDENT(S) ADDRESS (If not residing with instructor)

a. STREET (Include apartment or suite number)

b. CITY

c. STATE

d. ZIP CODE

DD FORM 2754, DEC 2017

PREVIOUS EDITION IS OBSOLETE.

Reset

Adobe Professional 7.0

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2