Form Dr-190 Draft - Application For Fuel Tax Refund Non-Public Schools Page 2

ADVERTISEMENT

Important Information Concerning Application for Fuel Tax Refund

DR-190

Non-Public Schools Claim

R. 01/18

Page 2

A Power of Attorney, Florida Department of Revenue Form DR-835, must be properly

executed and included if this application is prepared by your representative.

1.

Permit holders are entitled to a refund of the fuel sales tax

B. Department of Environmental Protection storage tank

levied under ss. 206.41 (1) (g) and 206.87 (1)(e) of Chapter

facility identification number of the tank where the

206, F.S., on gasoline, gasohol, and undyed diesel fuel

motor fuel was stored prior to purchase or the federal

purchased. The applicable tax rates are entered by the

employee identification number of the seller.

Department and are published annually in Tax Information

C. Type of motor fuel you purchased using the product

Publications on the Department's website at:

types listed at the top of the schedules.

D. Sales invoice number.

2.

Applications are to be used only for the quarter indicated

on the face of this application. Only original refund

E. Date that you took possession of the motor fuel from

applications are acceptable. Application forms may be

the supplier (must be within this calendar quarter).

requested from the Department of Revenue, Refunds.

F. County in which you took possession of the motor fuel

3.

Refund permits are renewed on an annual basis only if the

from the supplier.

permit holder files quarterly claims during the year.

G. Total price you paid for the motor fuel purchased.

4.

Applications must be filed quarterly, no later than the last

H. Number of gallons of motor fuel you purchased.

day of the month immediately following the quarter. The

filing date may be extended one additional month only if

7.

In the event of overpayment of any refund, the

a justified, written excuse is submitted with the claim and

Department of Revenue will refuse to make further

only if the prior quarter’s claim was filed on time.

refunds and advise the payee of the amount to be

reimbursed.

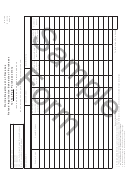

Purchases Made

Claims Must Be

With A Written

During

Filed By *

Excuse -

8. Gallons that you purchased during the previous year and

No Later Than

consumed during the current quarter will not be eligible

for the full refundable rate for the current year. Instead,

January, February,

April 30

May 31

and March

these gallons should be multiplied by last year’s rate. This

adjustment will compensate for any inventory that was

April, May, and

July 31

August 31

June

assessed at last year’s rate and carried forward to the

current calendar year.

July, August, and

October 31

November 30

September

October, November,

January 31

February 28

Line-by-Line Instructions

and December

*Amended application for prior quarter must be received

Purchases of Gasoline, Gasohol, and Undyed Diesel Fuel.

by current quarter’s deadline. Example: You must submit

an amended March quarterly application by July 31.

Line 1. Beginning Inventory – Must be the same as

your closing inventory from the prior quarter.

5.

Each permit holder must maintain records to substantiate:

If the prior quarter’s claim was not filed, enter

• Fuel was used by a qualified applicant

zero.

• Fuel taxes were paid on the refundable gallons

• Gallons reported as Beginning and Ending Inventory

Line 2. Gallons Purchased – This represents fuel you

• Fuel was used in an eligible manner

purchased during the calendar quarter. These

When copies of your records are required to determine

purchases must be supported by the Schedule

the amount of refund due, the Department will issue a

of Purchases (Page 3).

written request to you within 30 days of the receipt of

Line 3. Closing Inventory – Actual physical inventory as

your application. Your application for a refund is not

of the last day of the quarter printed on Page

complete until the requested records are received by the

1. This will be your beginning inventory for the

Department.

next quarter. If no refund is due but a

closing inventory exists, the claim form

6.

The Schedule of Purchases (Page 3), detailing the

must be filed.

information listed below, may be submitted instead of

Line 4. Total Consumption – Line 1 plus Line 2

original invoices. Include only one product type listed

minus Line 3.

at the top of the Schedule of Purchases. Separate

Line 5. Gallons not eligible for refund – This

schedules must be used for each product type. However,

represents fuel purchased which was

first time filers of this form must submit tax paid invoices

used for “off-road” purposes.

with their initial refund request.

Line 6. Gallons claimed for refund – This

A. Name and address of supplier that you purchased

represents fuel used in a motor vehicle

motor fuel from.

operated by the permit holder.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3