Form Dr-133 - Gross Receipts Tax Return

ADVERTISEMENT

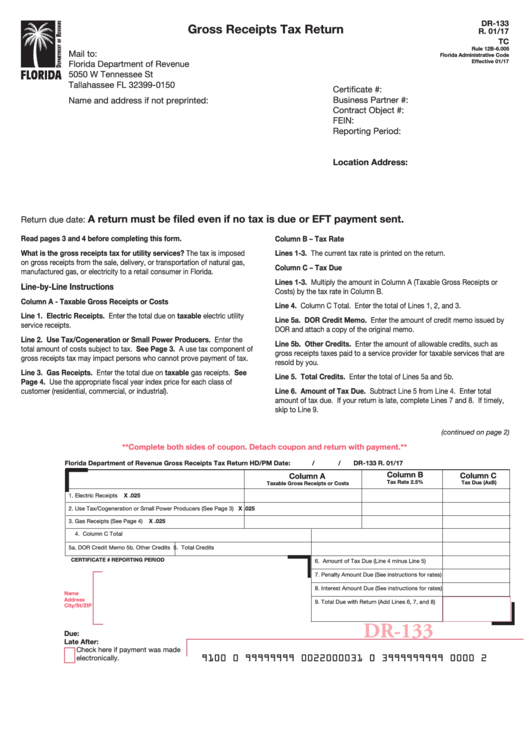

DR-133

Gross Receipts Tax Return

R. 01/17

TC

Rule 12B-6.005

Mail to:

Florida Administrative Code

Effective 01/17

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL 32399-0150

Certificate #:

Business Partner #:

Name and address if not preprinted:

Contract Object #:

FEIN:

Reporting Period:

Location Address:

A return must be filed even if no tax is due or EFT payment sent.

Return due date:

Read pages 3 and 4 before completing this form.

Column B – Tax Rate

What is the gross receipts tax for utility services? The tax is imposed

Lines 1-3. The current tax rate is printed on the return.

on gross receipts from the sale, delivery, or transportation of natural gas,

Column C – Tax Due

manufactured gas, or electricity to a retail consumer in Florida.

Lines 1-3. Multiply the amount in Column A (Taxable Gross Receipts or

Line-by-Line Instructions

Costs) by the tax rate in Column B.

Column A - Taxable Gross Receipts or Costs

Line 4. Column C Total. Enter the total of Lines 1, 2, and 3.

Line 1. Electric Receipts. Enter the total due on taxable electric utility

Line 5a. DOR Credit Memo. Enter the amount of credit memo issued by

service receipts.

DOR and attach a copy of the original memo.

Line 2. Use Tax/Cogeneration or Small Power Producers. Enter the

Line 5b. Other Credits. Enter the amount of allowable credits, such as

total amount of costs subject to tax. See Page 3. A use tax component of

gross receipts taxes paid to a service provider for taxable services that are

gross receipts tax may impact persons who cannot prove payment of tax.

resold by you.

Line 3. Gas Receipts. Enter the total due on taxable gas receipts. See

Line 5. Total Credits. Enter the total of Lines 5a and 5b.

Page 4. Use the appropriate fiscal year index price for each class of

customer (residential, commercial, or industrial).

Line 6. Amount of Tax Due. Subtract Line 5 from Line 4. Enter total

amount of tax due. If your return is late, complete Lines 7 and 8. If timely,

skip to Line 9.

(continued on page 2)

**Complete both sides of coupon. Detach coupon and return with payment.**

Florida Department of Revenue

Gross Receipts Tax Return

HD/PM Date:

/

/

DR-133 R. 01/17

Column B

Column C

Column A

Tax Rate 2.5%

Tax Due (AxB)

Taxable Gross Receipts or Costs

1. Electric Receipts

X .025

2. Use Tax/Cogeneration or Small Power Producers (See Page 3)

X .025

3. Gas Receipts (See Page 4)

X .025

4. Column C Total

5a. DOR Credit Memo

5b. Other Credits

5. Total Credits

CERTIFICATE #

REPORTING PERIOD

6. Amount of Tax Due (Line 4 minus Line 5)

7. Penalty Amount Due (See instructions for rates)

8. Interest Amount Due (See instructions for rates)

Name

Address

9. Total Due with Return (Add Lines 6, 7, and 8)

City/St/ZIP

DR-133

Due:

Late After:

Check here if payment was made

electronically.

9100 0 99999999 0022000031 0 3999999999 0000 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4