Form Cd-425 - Corporate Tax Credit Summary - 2014

ADVERTISEMENT

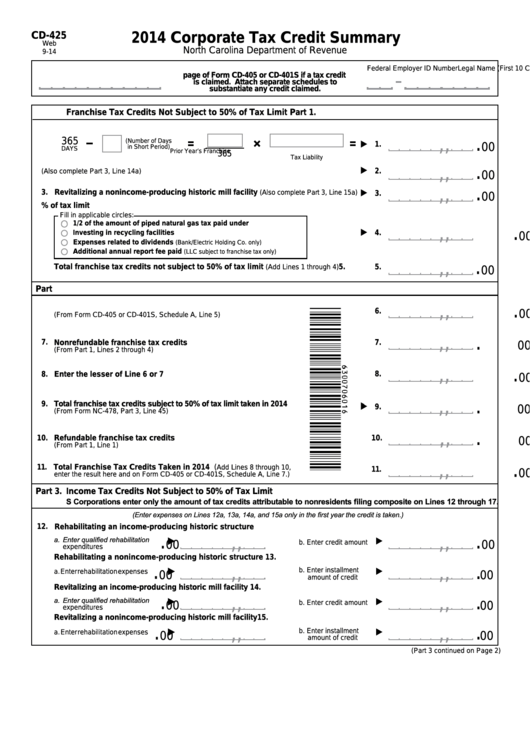

CD-425

2014 Corporate Tax Credit Summary

Web

North Carolina Department of Revenue

9-14

Form CD-425 must be attached to the last

Legal Name (First 10 Characters)

Federal Employer ID Number

page of Form CD-405 or CD-401S if a tax credit

is claimed. Attach separate schedules to

substantiate any credit claimed.

Part 1.

Franchise Tax Credits Not Subject to 50% of Tax Limit

1. Short period credit for change in income year

,

,

.

365

(Number of Days

1.

00

in Short Period)

DAYS

Prior Year’s Franchise

365

Tax Liability

.

,

,

2. Revitalizing an income-producing historic mill facility

2.

(Also complete Part 3, Line 14a)

00

.

,

,

3. Revitalizing a nonincome-producing historic mill facility

(Also complete Part 3, Line 15a)

3.

00

4. Other franchise tax credits not subject to 50% of tax limit

Fill in applicable circles:

1/2 of the amount of piped natural gas tax paid under G.S. 105-187.43

,

,

.

4.

Investing in recycling facilities

00

Expenses related to dividends

(Bank/Electric Holding Co. only)

Additional annual report fee paid

(LLC subject to franchise tax only)

.

,

,

5.

Total franchise tax credits not subject to 50% of tax limit

5.

(Add Lines 1 through 4)

00

Part 2. Computation of Franchise Tax Credits Taken in 2014

.

,

,

6. Total franchise tax due

6.

00

(From Form CD-405 or CD-401S, Schedule A, Line 5)

,

,

.

7.

7.

Nonrefundable franchise tax credits

00

(From Part 1, Lines 2 through 4)

,

,

.

8.

Enter the lesser of Line 6 or 7

8.

00

,

,

.

9.

Total franchise tax credits subject to 50% of tax limit taken in 2014

9.

00

(From Form NC-478, Part 3, Line 45)

.

,

,

10.

Refundable franchise tax credits

10.

00

(From Part 1, Line 1)

.

,

,

11. Total Franchise Tax Credits Taken in 2014 (

Add Lines 8 through 10,

11.

00

enter the result here and on Form CD-405 or CD-401S, Schedule A, Line 7.)

Part 3.

Income Tax Credits Not Subject to 50% of Tax Limit

S Corporations enter only the amount of tax credits attributable to nonresidents filing composite on Lines 12 through 17.

(Enter expenses on Lines 12a, 13a, 14a, and 15a only in the first year the credit is taken.)

12. Rehabilitating an income-producing historic structure

.

.

,

,

,

,

a. Enter qualified rehabilitation

b. Enter credit amount

00

00

expenditures

13.

Rehabilitating a nonincome-producing historic structure

.

.

,

,

,

,

b. Enter installment

a. Enter rehabilitation expenses

00

00

amount of credit

14.

Revitalizing an income-producing historic mill facility

.

.

,

,

,

,

a. Enter qualified rehabilitation

b. Enter credit amount

00

00

expenditures

15.

Revitalizing a nonincome-producing historic mill facility

.

.

,

,

,

,

b. Enter installment

a. Enter rehabilitation expenses

00

00

amount of credit

(Part 3 continued on Page 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2