DR 0800 (01/05/18)

Location/Jurisdiction Codes for Sales Tax Filing

County, use the code 10-0206. For businesses such as

Sales tax filers with two or more locations/sites may

telecommunication or utility companies that make sales in

file by XML (Extensible Markup Language) or Excel

unincorporated areas of any Colorado county but do not

spreadsheet. A list of XML approved software vendors

have a physical location in such areas, use the code

is available on the website

10-0207.

under Multiple Location/Jurisdiction Filers. Use of the

department's pre-approved XML software does not require

Applying for Non-Physical Sites

individual approval. For the Excel spreadsheet, there is

a template and handbook on the Web site. Use of the

To apply for non-physical sites, email

Excel spreadsheet requires individual approval by the

dor_multilocations@state.co.us.

For each site include the

department before it can be used.

city name, county, location/jurisdiction code and a ZIP

code. Use the View Business Location Rates system,

When you file sales tax returns by paper or XML/

available at to:

Excel spreadsheet, you must use the six digit location/

• Verify open sites

jurisdiction codes. For more information please see online

The location/

sales tax at

• Verify the four-digit location code on your sales

jurisdiction code is determined by the location

tax account.

address of the actual site location.

• Verify tax rates at each location.

*Note: For sales made in unincorporated areas of any

• Verify location jurisdiction codes for each of your

Colorado county (not within any city or town), use the

locations.

county code and the code "0206", which is a generic

When not using a preprinted DR 0100, be sure to put the

designation. The designation of an unincorporated

six-digit jurisdiction code on the far right side of the "Due

area must be verified with the county assessor's office.

Date" box, right above the "Period" box on the DR 0100.

For example, for sales in unincorporated Arapahoe

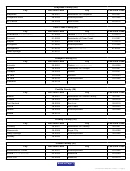

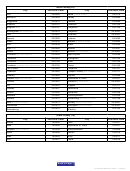

Counties listed below are hyperlinks. Click on desired county to navigate directly to that list.

Adams County

Denver County

Kit Carson County

Phillips County

Alamosa County

Dolores County

Lake County

Pitkin County

Arapahoe County

Douglas County

La Plata County

Prowers County

Archuleta County

Eagle County

Larimer County

Pueblo County

Baca County

Elbert County

Las Animas County

Rio Blanco County

Bent County

El Paso County

Lincoln County

Rio Grande County

Boulder County

Fremont County

Logan County

Routt County

Broomfield County

Garfield County

Mesa County

Saguache County

Chaffee County

Gilpin County

Mineral County

San Juan County

Cheyenne County

Grand County

Moffat County

San Miguel County

Clear Creek County

Gunnison County

Montezuma County

Sedgwick County

Conejos County

Hinsdale County

Montrose County

Summit County

Costilla County

Huerfano County

Morgan County

Teller County

Crowley County

Jackson County

Otero County

Washington County

Custer County

Jefferson County

Ouray County

Weld County

Delta County

Kiowa County

Park County

Yuma County

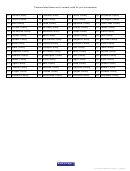

Location/Jurisdiction Codes — Page 1

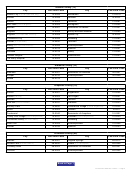

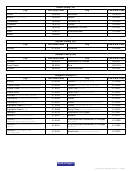

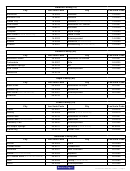

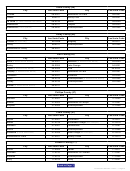

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16